How My Wife and I Do Our Year-End Financial Reset (and What 2025 Taught Us)

Every year, sometime between Christmas and New Year’s, my wife and I sit down at the dining table with our laptops and coffee and do something that’s become one of the most important rituals in our financial life.

We don’t start with investments.

We don’t start with net worth.

We don’t even start with money.

We start with getting organized.

Over time, I’ve learned that financial clarity doesn’t come from knowing how much you have. It comes from knowing where everything lives, who can access it, and what happens if something goes wrong.

Before I reflect on what 2025 looked like financially, I want to explain how we actually do our year-end reset — because without this system, the numbers don’t mean much.

One Shared Home for Everything

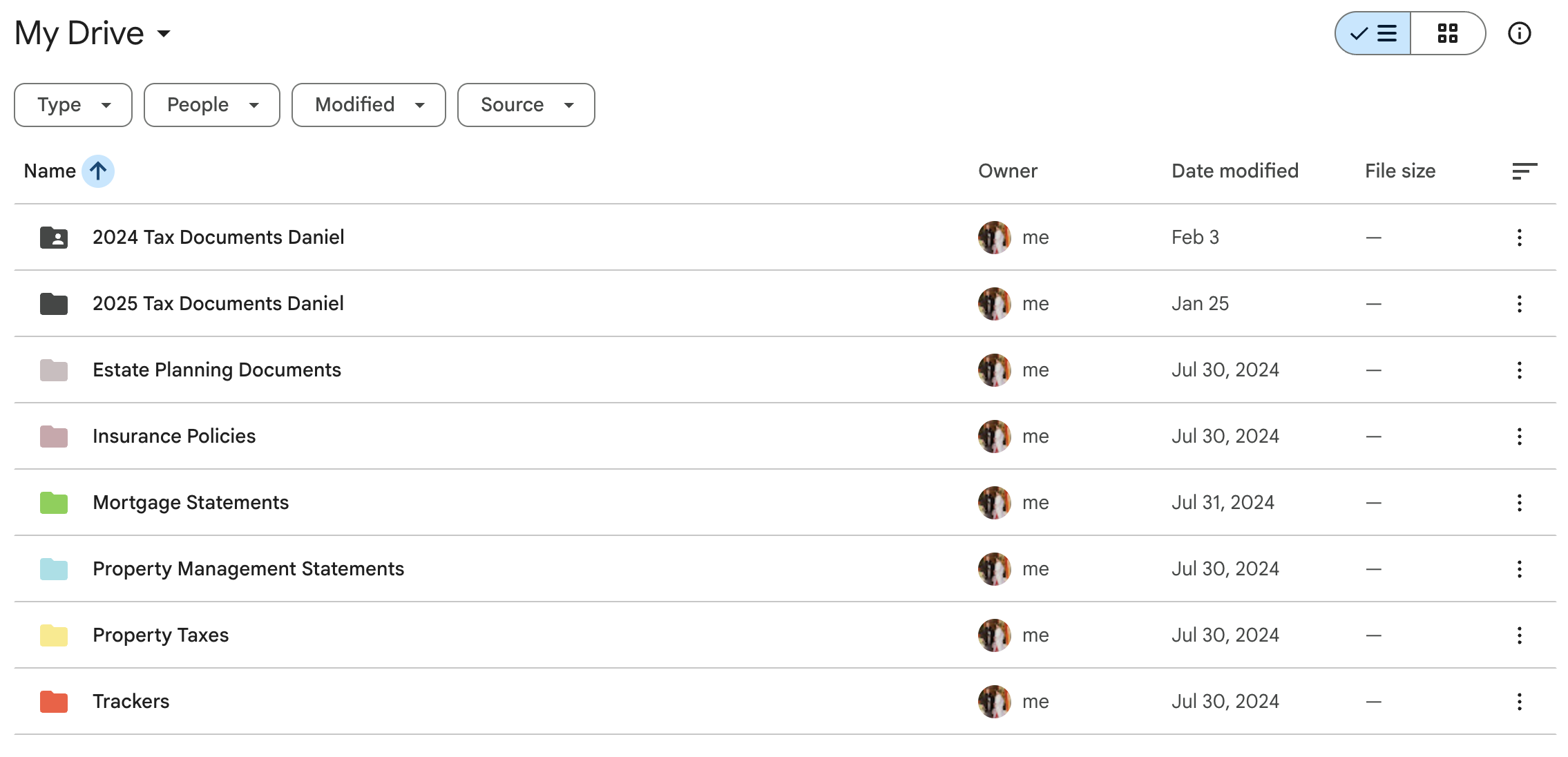

The foundation of our system is simple: one shared Google Drive.

All of our financial documents live there — tax documents by year, insurance policies, mortgage statements, property management reports, estate planning documents, and all of our trackers.

If you look at the screenshots below, you’ll notice how boring the structure is. That’s intentional. Clear folder names. Consistent organization. Nothing clever.

At the end of the year, we go through every account together and make sure the latest statements are downloaded and filed. Brokerage accounts, bank accounts, property manager statements, insurance policies — everything.

It’s not exciting work, but once it’s done, there’s a noticeable sense of calm.

Making Sure Either of Us Could Step In

Organization only works if access is shared.

We use a family password manager so that both of us can log into every bank, brokerage, property management portal, insurance site, and subscription we rely on. There’s no “only one of us knows how this works.”

Because we live outside the U.S., we also use a VPN to access financial sites that block foreign IP addresses or behave differently overseas.

And we keep an old iPhone with a U.S. phone number. Its entire job is to receive verification codes. If you’ve ever been locked out of an account because a bank insists on sending an SMS to a U.S. number, you understand why this matters.

None of this is fancy. All of it prevents stress.

Updating the Numbers Together

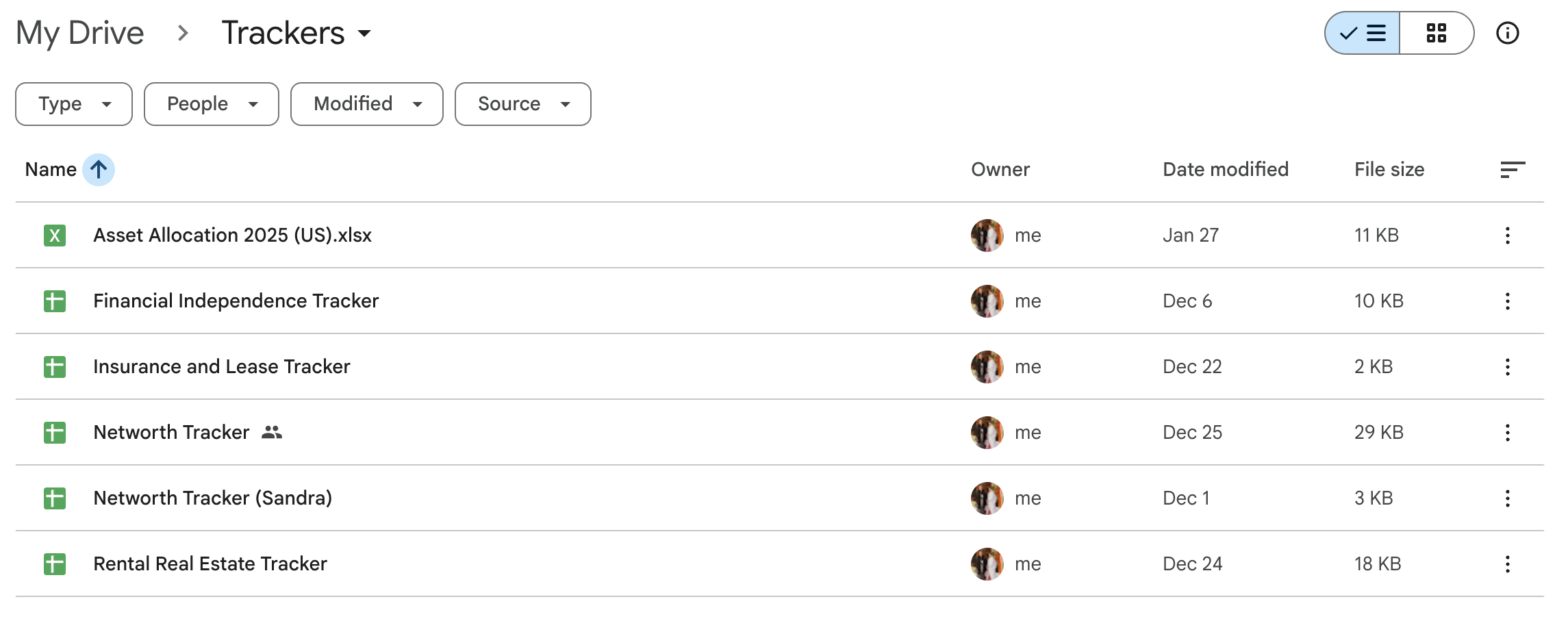

Only after everything is organized do we open our trackers.

We update our net worth, rental property tracker, asset allocation, and financial independence sheet together — line by line, no estimates, no shortcuts.

Doing this as a couple matters. The numbers stop being abstract. There are no surprises, no secrecy, and no mental burden carried by just one person.

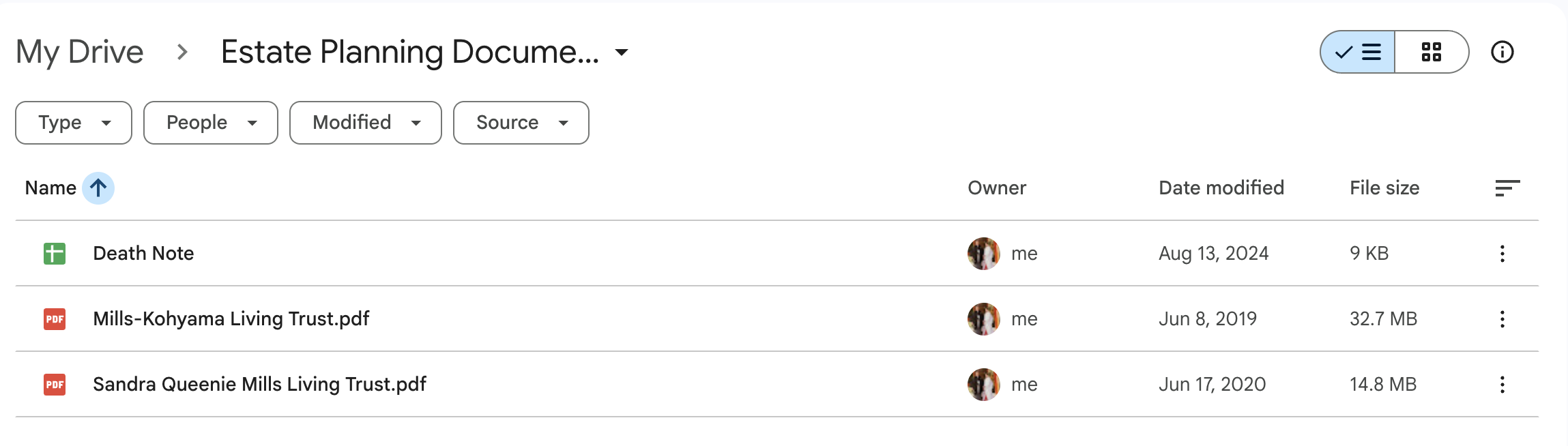

The Document We Hope We Never Need

The final step is updating what we half-jokingly call our “Death Note.”

It’s a living document that explains where everything is, who to contact, and what steps to follow if one of us is incapacitated or dies.

It’s uncomfortable. It’s also one of the most practical and caring things you can do for your spouse.

What 2025 Looked Like at a High Level

Only after all of that is done do we step back and look at the year itself.

From a big-picture perspective, 2025 was a year of progress.

Our net worth increased by just under 7%, driven by steady market growth, continued investing, and ongoing debt paydown. We also crossed a meaningful psychological milestone in our investment accounts — one that took many years of boring consistency to reach.

At the same time, we deliberately reduced idle cash and moved toward a more balanced mix of liquidity and long-term investments. That shift mattered more than any single market move.

Rental Properties: Profitable, but Uneven

Our rental portfolio was profitable overall in 2025, but the experience was far from smooth.

Most properties did exactly what you want rentals to do:

Collected rent

Covered expenses

Quietly built equity

One property, however, dominated the year.

A prolonged vacancy and eviction turned a single house into a financial and mental drain. While the rest of the portfolio performed well, that one situation absorbed a disproportionate amount of cash flow and attention.

It was a reminder that in real estate, risk isn’t evenly distributed. One problem property can easily overshadow a dozen boring, well-behaved ones.

Why Cash Flow Isn’t the Whole Story

One thing that’s easy to forget — especially online — is that rental performance isn’t just about monthly cash flow.

Even in a year with setbacks, tenants continued to pay down loan principal and build long-term equity in the background. That doesn’t make a bad situation feel good in the moment, but it does matter when you zoom out.

Why I Share the Full Numbers Privately

Each year, I write two versions of this reflection.

This is the public one.

The private version includes:

My actual net worth figures

A full rental cash-flow breakdown

What that eviction really cost us

What I’m changing structurally going forward

I only share that version with my email list — not because the numbers are special, but because context matters, and I want to share them with readers who genuinely want the full picture.

If you’d like to read the complete version with real numbers, you can join below. I don’t email often — but once a year, I share everything.

👉 [Join the mailing list to receive the private year-end financial review]

Looking Ahead

I’m currently working on spreadsheets and guides for 2026 that will help others — especially U.S. expats — build systems like this for their own finances.

The goal isn’t perfection. It’s clarity, resilience, and peace of mind.

More soon.

How I Built My Own AI Family Office in ChatGPT (and How You Can Too)

A step-by-step guide to turning ChatGPT into your personal financial advisory team.

When your finances straddle two countries, you need answers that no single adviser can give. U.S. tax code, Japanese residency rules, rental property portfolios, blue-form accounting—it’s a lot.

That’s why I’m building something new: a virtual family office inside ChatGPT.

Why I’m Doing This

I’ve spent years managing U.S. real estate, Japanese investments, and complex tax filings. I already have accountants and lawyers, but they work in silos. What I wanted was a central intelligence—a private workspace where every financial, legal, and tax perspective could meet and reason together.

That’s where ChatGPT’s Projects come in. A Project can hold documents, remember context, and act as a persistent “AI team.” I’m training mine to become the Mills-Kohyama Living Trust Family Office—an AI version of a cross-border wealth-management team.

The Vision: An Integrated Advisory Team

Inside this Project, I’ve defined virtual specialists:

Chief Financial Strategist (CFP US & JP) – integrates all advice.

Cross-Border Tax Director (CPA US & JP) – handles FEIE, FTC, PFIC, and treaty rules.

Real Estate & Asset Manager (MBA – Real Estate Finance) – analyzes every property.

Investment Architect – designs portfolios across NISA, iDeCo, IRAs, and taxable accounts.

Legal & Estate Counsel (JD US & JP) – aligns trusts, inheritance, and entity structures.

Insurance & Risk Analyst – models protection and umbrella coverage.

Behavioral Finance Advisor – keeps the plan grounded in goals and values.

Every answer they produce follows a fixed format:

Executive Summary → Specialist Commentaries → Implementation Steps → Assumptions (with separate U.S./Japan sections and treaty citations).

Setting Up the Project

1. Create the Workspace

From ChatGPT’s home screen, click Projects → New Project.

Name it Mills-Kohyama Living Trust Family Office.

Paste your system prompt (the description of your AI team and output rules).

This Project becomes your permanent, private financial workspace.

2. Build the File Library

I divided everything into five folders:

/MillsKohyama_FamilyOffice

├── 01_ClientData

├── 02_ReferenceFrameworks

├── 03_ProfessionalResources

├── 04_Context

└── 05_Scenarios_Models

The Essential “Binding” Documents

Start with these eight core references—your AI’s legal and tax backbone:

FileWhy It MattersUS_Japan_Tax_Treaty.pdfDefines which country taxes what income.US_Japan_Treaty_Technical_Explanation.pdfClarifies each article’s meaning.IRS_Pub54_TaxGuide_Abroad.pdfCore guide for Americans overseas (FEIE, FTC, housing).IRS_Form2555_Instructions_2023.pdfImplementation details for FEIE.Japan_Income_Tax_Act_EN.pdfJapan’s actual tax law.NTA_Income_Tax_Guide_2024.pdfHow the NTA interprets and applies those laws.NTA_Blue_Return_Overview.pdfKey for business income and deductions.US_Japan_SocialSecurity_Totalization.pdfGoverns pension and coverage rules.

(Download from official IRS, Treasury, NTA, or SSA sites.)

Later, you can enrich the library with practitioner guides from KPMG, EY, or PwC and NTA treaty-application forms—but this “spine” is enough to start.

Upload and Index

Upload the eight PDFs into your Project (in the order above).

Tell ChatGPT:

“Index these core references and create a one-page reference map summarizing each file, its key sections, and how it applies to cross-border financial planning for a U.S. citizen in Japan.”

It will summarize and cite them—your first proof the system is working.

Activate the Virtual Family Office

Now issue this command:

“Activate the Mills-Kohyama Living Trust Family Office.

Summarize how you’ll use these references to handle:

(a) employment income, (b) U.S. rental income taxed in Japan,

(c) capital gains on U.S. assets, (d) FEIE vs FTC,

and (e) Social Security Totalization.

State default assumptions (FX, inflation, yields, tax bands).”

The AI will outline its understanding and assumptions—edit them once, and they’ll persist.

Test Runs

Try quick “smoke tests” to verify accuracy:

Treaty Articles Check –

“Which treaty article governs dividends and capital gains, and what’s the summary rule?”FEIE vs FTC Comparison –

“Show two numeric examples comparing FEIE and FTC for an American living in Japan.”

If it answers correctly and cites sources, your family office is alive.

Expanding Over Time

Add your own spreadsheets later:

Investment_Portfolio.xlsx

RealEstate_Portfolio.xlsx

NetWorth_Snapshot.xlsx

Tax_Returns (US & JP)

Scenario_Retirement2030.xlsx

Each time you upload, prompt:

“Re-index today’s uploads and summarize new insights or discrepancies.”

That keeps your AI team current without starting over.

Why This Works

Persistent context: Projects remember your files and updates.

Private data: Everything stays in your workspace.

Interdisciplinary reasoning: AI blends tax, real estate, and investment logic.

Scalable: You can later add a separate Project for another trust or business.

Tips for Readers Who Want Their Own Version

Pick a name for your “office” (e.g., Smith Family Office, Tanaka Advisory Lab).

Create five folders as above.

Start with the eight essential documents.

Write a system prompt describing your virtual team and output structure.

Test, refine, and expand—add your own spreadsheets once the legal framework works.

Never upload sensitive IDs (use redacted or summarized data).

Schedule quarterly updates just as a real adviser would.

Closing Thoughts

The financial world isn’t getting simpler. Cross-border investors, digital nomads, and expats often juggle two tax codes, two economies, and multiple currencies. Building an AI-powered family office inside ChatGPT doesn’t replace human professionals—but it unites them in one brain. That’s what I’m doing with the Mills-Kohyama Living Trust Family Office: creating a permanent, evolving command center for my wealth, taxes, and real estate across borders.

You can do it too—one project, eight documents, and a vision of financial independence made smarter by AI.

⚖️ Disclaimer

This article is for educational and informational purposes only and does not constitute financial, legal, or tax advice.

Readers should consult licensed professionals (CPA, CFP, tax attorney, etc.) before making financial or legal decisions.

The tools and methods described here are examples of how AI can support personal organization and learning, not a substitute for personalized advice.

What We Can Learn from TIGER 21’s Asset Allocation

One of the most interesting things about building wealth is that there isn’t just one “right” way to do it. The choices we make depend on our goals, experiences, and tolerance for risk. Still, it can be helpful to look at what the ultra-wealthy are doing with their money to see if there are lessons we can apply to our own financial journeys.

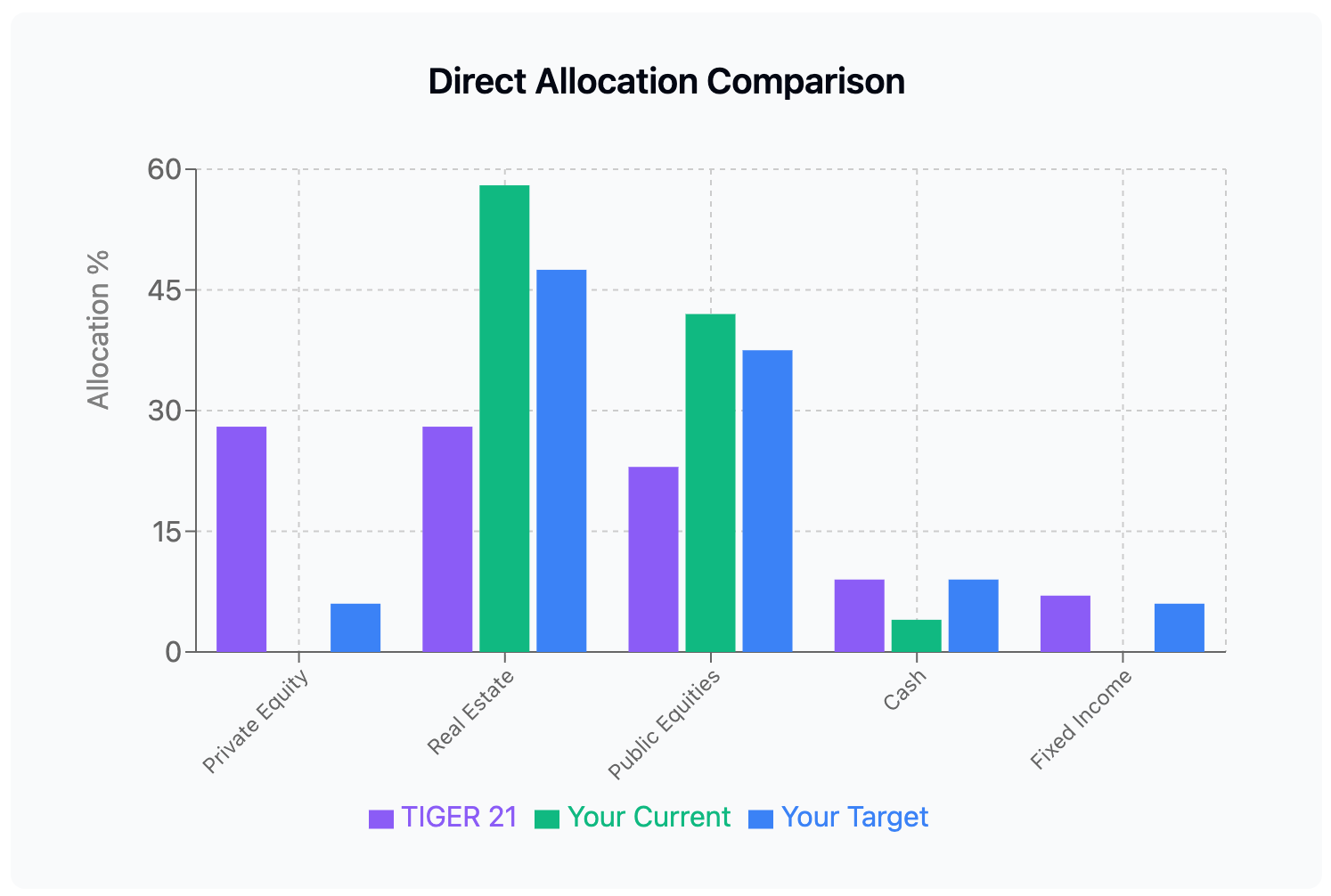

Recently, I came across the latest asset allocation report from TIGER 21, a private network of ultra-high-net-worth individuals. Their portfolios look very different from what most of us are used to—and it made me think about how my own portfolio stacks up against theirs.

👉 You can get the full report here: TIGER 21 Asset Allocation Report Q2 2025

What Is TIGER 21?

TIGER 21 (The Investment Group for Enhanced Results in the 21st Century) is a global, invitation-only network of more than 1,400 members, each with at least $20 million in investable assets. Members include entrepreneurs, executives, and investors who meet regularly in small groups to share candid advice and feedback on how they manage their wealth.

One of the unique features of TIGER 21 is the “Portfolio Defense.” In these sessions, a member presents their complete financial picture—assets, liabilities, income, and expenses—for constructive critique from peers. The aggregated results form the basis of the quarterly Asset Allocation Report.

In other words: TIGER 21 gives us a rare, behind-the-curtain look at how some of the world’s wealthiest individuals are structuring their money.

TIGER 21’s Latest Allocation (Q4 2024)

Here’s how members allocated their wealth on average:

Private Equity: 28%

Real Estate: 28%

Public Equities: 23%

Cash & Equivalents: 9%

Fixed Income: 7%

Hedge Funds: 2%

Currencies, Commodities, Miscellaneous: ~3% combined

That means more than half their wealth is in alternatives—private equity and real estate—while still maintaining significant liquidity (cash and bonds) and exposure to public markets.

My Current Portfolio

Now, let’s compare this to my own allocation as of mid-2025:

Real Estate (Residential): ~58%

Public Equities (U.S. & Japan): ~42%

Includes ~1% cryptocurrency

Includes a small percentage of bonds within my Japanese DC plan

Cash: ~4%

Private Equity / Alternatives: 0%

Like TIGER 21 members, I lean heavily on real estate. It’s the backbone of my cash flow and a space I know well. But compared to TIGER 21’s average, I’m overweight in property and underweight in liquidity and diversification.

Lessons from TIGER 21

So, what does this comparison suggest? Here are a few takeaways I’m considering for my own strategy:

1. Rebalance Real Estate Exposure

TIGER 21 members keep real estate at around 28%, while I’m closer to 58%. That’s fine for now since real estate produces strong cash flow for me, but over time I may want to trim or refinance to reduce concentration and free up capital for other opportunities.

2. Increase Liquidity

At just 4% in cash, I’m well below TIGER 21’s 9% allocation. Boosting this to 8–10% would give me flexibility—especially as I prepare for my sabbatical in the U.S. (2026–27) and look at new investment opportunities.

3. Add Stability Through Fixed Income

I have only limited bond exposure through my Japanese retirement account. Allocating even 5–7% more directly to U.S. Treasuries or JPY bond ETFs could add stability and predictable income.

4. Consider Alternatives

Private equity makes up nearly a third of TIGER 21’s allocation. While I don’t need to jump into that level, carving out 5–7% for carefully chosen syndications, funds, or business investments could diversify returns without overwhelming the portfolio.

5. Maintain Strong Equity Exposure

At 42%, I’m above TIGER 21’s 23% in public equities. That’s actually a strength for me—liquid, globally diversified investments are a good counterbalance to my real estate holdings.

A Possible Restructured Allocation

Here’s a medium-term target allocation that blends my current reality with lessons from TIGER 21:

Real Estate: 45–50%

Public Equities (incl. crypto + bonds): 35–40%

Cash: 8–10%

Fixed Income: 5–7%

Private Equity / Alternatives: 5–7%

This mix still leans on real estate as my foundation but adds more liquidity, stability, and optionality—important as I transition toward financial independence. Here’s a side-by-side look at how TIGER 21 members allocate their wealth, how my portfolio is structured today, and what it could look like after a strategic rebalance.

Connecting Back to My Goals

My long-term target is clear:

$3 million net worth

$125,000 per year in sustainable cash flow/withdrawals

If I hit $3M and allocate according to the target mix, here’s how the numbers might play out using conservative return assumptions:

What This Means

Even on the conservative side, this structure meets and slightly exceeds my $125K/year goal. Real estate remains the workhorse for steady cash flow, but equities and bonds provide stability, while cash and private equity add flexibility and upside.

Most importantly, this allocation spreads income across multiple sources—reducing risk and making the plan more resilient through different market cycles.

Final Thoughts

I’m not TIGER 21 material (yet!), but looking at how the ultra-wealthy invest has given me perspective. Their allocations reflect decades of entrepreneurial experience and a desire for both growth and resilience.

For me, the lesson is clear:

Keep real estate and equities as my core.

Add more liquidity and fixed income for flexibility.

Carefully introduce alternatives for diversification.

The big picture? Even if we’re not managing nine-figure fortunes, we can learn a lot by studying how the wealthiest structure their portfolios. The key is not to copy them blindly, but to adapt the principles to our own goals and stage of life.

👉 Question for readers: If you compared your portfolio to TIGER 21’s, where would you be overweight or underweight? And how would that change your path toward financial independence?

Disclaimer

This article is for educational purposes only and does not constitute financial or legal advice. Please consult a certified financial planner or tax professional before making investment decisions, especially concerning U.S. residency requirements for bank and brokerage accounts, as this is a grey area and may have legal implications. Always conduct thorough due diligence.

Running Your Finances Like a Virtual Family Office

Even If You Don’t Have a Yacht (or Kids)…

When most people hear the words “family office,” they picture billionaires with private chefs, offshore trusts, and someone named Charles managing the family art collection.

That’s not you. It’s not me either.

But here’s the thing: you don’t need a billion-dollar portfolio to benefit from the family office model. With a little planning and the right mindset, anyone can build what’s called a Virtual Family Office — and use it to manage wealth, create freedom, and leave a lasting legacy.

I’ve been building mine for the past few years. And in this post, I want to show you how you can too — whether you’re crossing your first $300K or aiming for $3 million.

What Is a Virtual Family Office?

Traditionally, a family office is a private company created by ultra-wealthy families to manage their investments, taxes, estate plans, charitable giving, and family affairs.

They usually have full-time staff, expensive advisors, and overhead that can run $500K to $1M+ per year.

But most of us don’t need all that.

A Virtual Family Office (VFO) takes the same core functions and runs them lean:

You stay in control — you’re the CEO of your wealth.

You hire outside professionals when needed.

You use systems and documentation to stay organized.

And you plan not just for yourself, but for the people and values you care about most.

Why I’m Building One — and Why You Might Want To

This isn’t about luxury or status. For me, a VFO is about being organized, intentional, and future-focused.

Even though I don’t have children, I have a spouse I love and family I want to support. I’ve worked hard to build wealth through real estate, index funds, and smart saving. But if I’m gone tomorrow — would my wife know where everything is? Would my family know what to do with what I’ve left them? Would my values still guide what happens next?

That’s why I’m building a VFO. Not to make my life more complicated — but to make my family’s life simpler, more protected, and more aligned with the legacy I want to leave.

The Building Blocks of a Virtual Family Office

Let’s walk through what goes into a VFO and how you can start building one at any stage of wealth.

Define Your Team

Every family office has a team. You don’t need employees — but you do need go-to professionals and a clear understanding of who does what.

Here’s what my team might look like by the time I hit a $3M+ net worth:

VFO Org Chart

I don’t need to build a company — I just need a small, efficient circle of trusted advisors I can call when decisions get complex. And if you aren’t ready to add certain members to your team, you can place yourself or a family member in that position. For example, I am currently our Investment Consultant and my wife is our Bookkeeper.

Create Your Investment Strategy

Most wealthy families have a written investment strategy — not just a hunch.

I keep mine simple, on one page, and update it annually.

Target Allocation:

35% Equities (broad global diversification)

35% Real Estate (residential, commercial)

15% Bonds or private credit

10% Private equity or venture

2% Alternatives (crypto, precious metals)

3% Cash or equivalents

Rules:

Rebalance in December.

Stick to index funds and value-add real estate.

Don’t invest emotionally — invest intentionally.

It doesn’t have to be fancy. It just has to be clear.

Build an Estate and Legacy Plan

Estate planning isn’t just for people with children. It’s for anyone who doesn’t want to leave a mess behind.

Here’s what I’ve done or am working on:

Estate Plan

Educate the People You’ll Leave Behind

We spend so much time building wealth — and so little time preparing others to manage it.

Here’s how I’m addressing that:

A Family Wealth Binder (or cloud-based folder) with all essential documents, account overviews, instructions, and emergency contacts.

A plain-English financial summary for my wife — so she’s not left navigating complex systems in the dark.

Ongoing mentorship for my family members if they’re ever interested in real estate, investing, or personal finance.

A simple legacy letter that tells the story behind my decisions and what I hope the next generation will carry forward.

You don’t need heirs to leave a legacy. You just need intention.

Structure for Tax and Legal Efficiency

Living abroad adds layers to wealth management — especially in countries like Japan, where transfers to LLCs or trusts can trigger unexpected taxes.

That’s why I’ve kept my current properties in a revocable living trust and rely on umbrella insurance for protection.

Going forward, new real estate investments will be made through LLCs from the start, and I’ll work closely with a cross-border CPA to minimize friction between the U.S. and Japan.

If you’re managing wealth across borders, this step isn’t optional — it’s foundational.

Protect What You’ve Built

As your wealth grows, so does your exposure to risk.

The VFO mindset includes a strong insurance strategy.

My current setup includes:

An umbrella policy of $2–5M to cover liability risks.

Property insurance for each rental based on full replacement value.

Health insurance through Japan’s national system, with supplemental coverage when abroad.

Optional life insurance, primarily for spousal liquidity, not wealth replacement.

We often talk about growing wealth — but protecting it is just as important.

Final Thoughts: Stewardship Over Ownership

Running your finances like a Virtual Family Office isn’t about looking rich — it’s about thinking like a steward.

It means:

You build systems that last.

You protect what you’ve earned.

You pass on values, not just dollars.

Whether you’re just starting or already financially independent, a VFO gives you structure, clarity, and purpose — and puts you in full control of your financial future.

You don’t need a yacht.

You just need a plan.

Want to Get Started?

Here are five steps you can take this month:

Write down your target asset allocation.

Review (or create) your trust, will, and POA.

Organize your key financial documents in one place.

Schedule a strategy session with a tax advisor.

Draft a one-page letter that explains your values and goals to the people you care about.

And if you want examples of how I’ve done this — or help building your own system — reach out anytime.

I don’t sell financial products. I just help you build financial freedom the smart way.

Disclaimer:

This blog is for educational and informational purposes only. It is not intended as financial, legal, or tax advice. Always consult with qualified professionals regarding your specific situation.

How I Teach Financial Literacy in Japan

And Why Every University Should Be Doing It

When I first started teaching financial literacy to my university students in Japan, I wasn’t sure what to expect. Would they care? Would the content feel too foreign or irrelevant? But year after year, I’m reminded that money is one of those topics that crosses borders, disciplines, and generations. Everyone—whether they admit it or not—is curious about how to manage it better.

What started as a small unit in my Communication Skills and English for Global Communication classes for economics students has evolved into something much more intentional: a four-lesson, grant-supported module funded by the Japan Society for the Promotion of Science (JSPS). I’m actively using this unit to collect data for my research on financial literacy education and behavioral change in young adults.

The method I’ve developed is both simple and layered: students start every task with nothing but pen, paper, and a worksheet, then progressively build up their understanding through technology and AI tools. This blend of analog calculation, digital learning, and AI tutoring helps ensure that the lessons stick—and that students aren’t just passively consuming information, but actively constructing their financial knowledge.

Why Teach Financial Literacy in an English Class?

Even though these students are economics majors, few have been taught how to manage their own money. That disconnect is a huge missed opportunity. By embedding financial education into an English course, we tackle multiple objectives at once:

Language learning with real-world application.

Critical thinking and data analysis.

Digital literacy, including responsible AI use.

Personal empowerment through money management.

And, frankly, the students love it—because for once, the subject matter feels immediately relevant to their lives.

The 4-Day Financial Literacy Journey: From Analog to AI

We start old school. Worksheets, calculations, handwritten notes. Students have to struggle with the numbers first. Then we introduce the tech—online videos, quizzes, retirement calculators, and AI language models like ChatGPT—to deepen their understanding and test their assumptions.

Here’s how it unfolds:

Day 1: Starting With Reality

We kick things off with a pre-survey using the Youth Financial Literacy Short Scale to capture where students stand in terms of financial knowledge, attitudes, and behaviors.

Then we dive into real-world financial storytelling through the CNBC Millennial Money episode featuring Gabriela Ariza:

👉 Living On $112K A Year In Brookfield, Illinois | Millennial Money

Gabriela’s journey from financial tragedy to becoming a money superstar always sparks rich discussion about resilience, budgeting, and long-term planning. Students are fascinated to see how someone close to their age navigated such adversity. (If you want to see what Gabriela is up to now, you can follow her on Instagram: @fab_millennial.)

We finish the session with reflective writing using our textbook, setting the stage for deeper financial exploration in the coming classes.

Gabriela Ariza

Day 2: Deepening Financial Knowledge with Digital Learning

Day 2 is our hybrid learning day. Using my co-authored textbook, Think Big for Business 1 (details here), students complete two structured activities:

Real Estate Investment Comparison: Students compare the pros and cons of investing in a countryside farmhouse versus an urban condo.

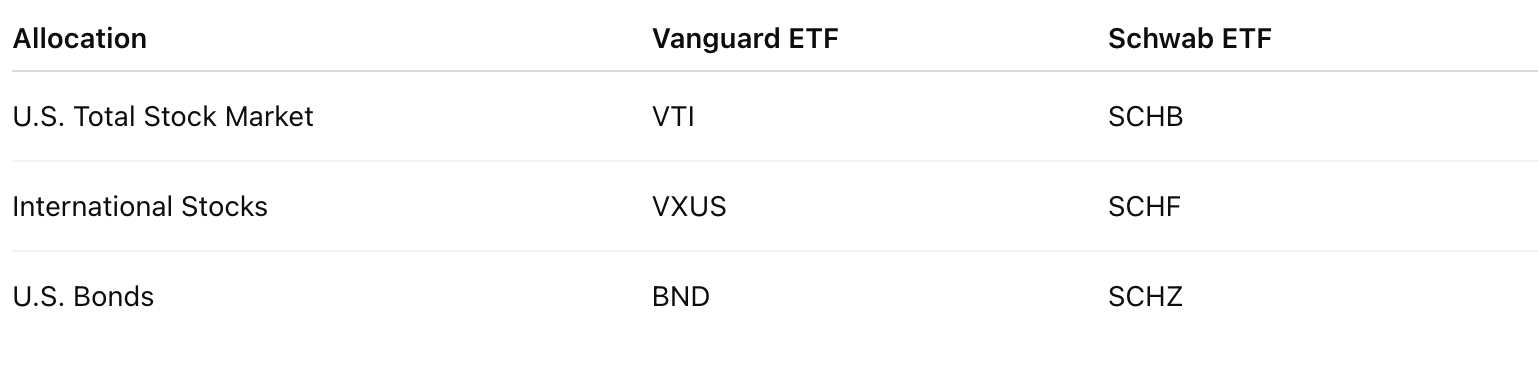

Creating a Diversified Investment Portfolio: They calculate how to distribute a monthly investment of $1,500 across US, Japanese, international, and real estate funds.

To supplement this, students watch the YouTube video “ACCOUNTANT EXPLAINS: How to Change Your Finances in 6 Months” by Nischa:

👉 Watch the Video

After watching, students complete a quiz on key concepts, such as:

Matching terms like index fund, emergency fund, bad debt, and net income.

Defining the ostrich effect.

Identifying the four key numbers to track.

Understanding decision fatigue and the role of automation.

Learning why “pay yourself first” is foundational.

This session layers vocabulary, conceptual understanding, and practical steps toward financial improvement.

Nischa:

Day 3: AI-Assisted Case Studies

Now it’s time to apply what they’ve learned. We begin by examining the Aya Financial Plan, a model example of a 28-year-old freelance graphic designer living in Kyoto who wants to retire by 60. We explore her income, expenses, budgeting, emergency fund, investment strategy, and her retirement target based on the 4% rule.

Then, in teams, students tackle one of four Japanese financial case studies, each with unique challenges—like balancing family expenses or reducing lifestyle inflation. They complete a handwritten financial worksheet, ensuring they understand every calculation.

Only after this do we introduce AI tools like ChatGPT. Students use AI to:

Validate their budget and retirement projections.

Seek investment recommendations.

Explore alternative financial strategies.

Compare systems in Japan and abroad.

Crucially, every group submits:

The handwritten worksheet with calculations.

A log of their AI usage, detailing prompts and reflections on AI’s strengths and weaknesses in financial planning.

Aya’s Financial Plan (Example Presentation I show Students)

Day 4: Presentations and AI Reflections

Each group presents their financial plan, explaining:

Budget revisions.

Investment strategy.

Projected retirement outcomes.

We also hold a structured reflection on AI:

What did you learn from using AI?

Did it help or hinder your understanding?

How might AI be useful in your studies or future career?

We close with a post-survey to measure growth in financial literacy and confidence. This feeds directly into my ongoing JSPS-funded research.

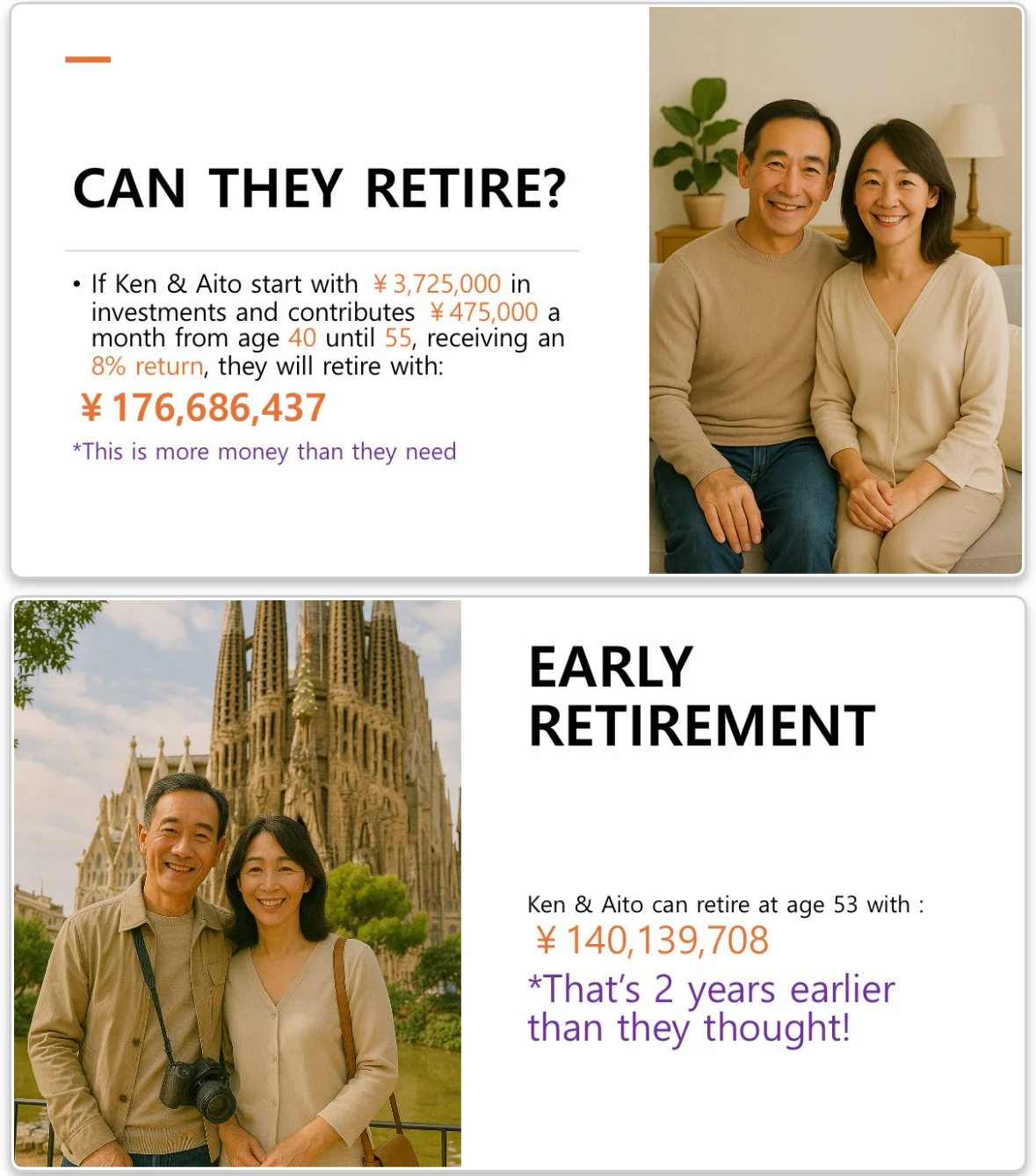

Example Slide from Student Presentation (1)

Example Slide from Student Presentation (2)

Why This Approach Works

There’s power in starting with analog tools, adding structured digital resources, and finishing with exploratory AI use. My students learn:

Financial concepts through doing, not just reading.

How to leverage technology responsibly.

That personal finance is solvable with the right tools.

They leave not just with knowledge—but with a practical roadmap they can adapt to their own lives.

Final Thoughts

I’m not trying to turn my students into financial advisors. But I do want them to feel that money isn’t mysterious—it’s manageable, predictable, and even empowering when you have the right skills.

If you’re an educator in Japan—or anywhere—and you want to explore the intersection of financial literacy, English education, and AI, I’d love to collaborate, swap ideas, or share resources.

— The FI Professor

📚 Resources From My Classroom

If you'd like to explore or adapt the materials I use in this unit, you can access everything here:

👉 Download the Full Financial Literacy Teaching Materials

This folder includes:

Aya Financial Plan (Model Example)

Financial Case Studies (4 Profiles of Japanese Adults)

Financial Worksheets (Hand Calculations + Planning Sheets)

Think Big for Business: Real Estate & Portfolio Activities

Student Quizzes and Prompts

Why I Love Having Assets in Both the U.S. and Japan

This summer, I’ll be heading back to the U.S. for a three-week vacation. I’m excited to see family, visit familiar places, and enjoy a change of pace. But one thing I won’t be doing? Worrying about the exchange rate.

That’s a huge shift from what many expats face. With the yen weaker than ever, plenty of Japan-based Americans are anxious about how expensive everything feels back home. Some delay their trips. Others stress about when to convert yen to dollars. But for me, that’s no longer part of the equation.

Why? Because I’ve spent the last several years building a financial system that spans both the U.S. and Japan. My life in Japan is funded by yen, and my time in the U.S. is funded by dollars. It’s not magic—it’s just a structure I’ve built over time that now allows me to live (and travel) without financial friction.

The Expat Currency Crunch

If you’ve lived in Japan for more than a few months, you know the pain of watching the yen weaken while your U.S. expenses remain fixed—or rise. Every meal, every hotel, every gift for family back home starts to feel 30–50% more expensive than it would’ve been a few years ago.

And when your entire income is in yen, that reality hits hard. You’re stuck trying to time conversions, watching rates, and feeling like your money just doesn’t go as far as it should.

That used to be me, too. But not anymore.

What My System Looks Like Today

These days, my U.S. rental properties generate enough income to cover everything I need while I’m in the States—flights, accommodation, transportation, meals, even entertainment. That income stays in dollars and is deposited directly into my U.S. bank accounts.

At the same time, all of my day-to-day life in Japan—mortgage-free housing, living expenses, savings, and investing—is handled entirely in yen. My university salary covers our needs, and I’ve set up Japanese brokerage accounts and tax-advantaged accounts for long-term investing.

Because of this, I no longer have to move money between countries. When I’m in Japan, I live in yen. When I’m in the U.S., I spend in dollars. And that separation has brought a surprising amount of peace of mind.

It Wasn’t Always This Easy

Getting to this point didn’t happen overnight. I had to put in the work: buying real estate in the U.S. from overseas, navigating international tax rules, keeping a valid U.S. address to maintain my brokerage accounts, and staying compliant on both sides.

There were some headaches. There still are sometimes. But looking back, the payoff in flexibility has made every challenge worth it.

Why I Recommend This to Other Expats

I think every American living abroad should consider setting up a financial system like this. Not necessarily with real estate (though it worked for me), but with something—some stream of U.S.-based income that can support you when you're in the States, whether that’s rental income, dividends, or freelance work.

It’s not just about convenience. It’s about diversification. You’re spreading risk across currencies, across economies, and across legal systems. And you’re giving yourself options—something that becomes more valuable the longer you live abroad.

I’ve also found tax benefits in both countries. In Japan, I can take advantage of my wife’s NISA account and contribute to a DC plan through work. In the U.S., real estate offers depreciation, expense deductions, and other ways to manage taxes. The key is not choosing one system over the other—it’s learning how to navigate both.

Living Without Financial Borders

The biggest benefit, though, has been psychological. I don’t feel stuck in one place. If we decided to spend more time in the U.S. or even relocate temporarily, I already have the infrastructure in place to make that transition smooth. No scrambling to open accounts or move money around—just living my life, supported by a financial system that works wherever I am.

It’s easy to get overwhelmed by the complexity of managing finances across borders. But it’s possible. And once it’s in place, it’s incredibly freeing.

Final Thoughts

When I was just starting out, I never imagined I’d be able to live this way—moving fluidly between two countries without worrying about currency swings or logistical headaches. But with time, patience, and a little strategy, I built a system that lets me live life on my own terms.

And if you’re living abroad right now, I hope you’ll consider doing the same. Because financial independence isn’t just about hitting a number—it’s about designing a life that works for you, wherever in the world you are.

– The FI Professor

Disclaimer:

This blog post is for informational and educational purposes only and does not constitute financial, tax, or legal advice. The strategies and experiences shared are based on my personal situation as a U.S. citizen living in Japan and may not be appropriate for everyone. Always consult with a qualified financial advisor, tax professional, or legal expert before making decisions related to cross-border investing, real estate, or tax planning. Laws and regulations can change and vary based on your residency status, citizenship, and personal financial goals.

What Happens to My U.S. Brokerage Account If I Lose My U.S. Address?

Living abroad as a U.S. expat comes with a long list of financial complexities. One that often gets overlooked—until it’s too late—is what happens to your U.S.-based investment accounts if you no longer have a valid U.S. address.

This topic has been on my mind more and more lately, so let me share a bit about my personal situation and what I've learned.

My Personal Concern

Right now, I still have a U.S. address—through a relative’s home. I’ve kept that address active and legitimate in several ways:

I maintain a driver’s license registered to that address

I pay a utility bill for the property

All of my financial institutions send their mail there

I continue to file and pay state taxes tied to that location

This setup allows me to keep my U.S. brokerage account open, even while living full-time in Japan.

But what happens if that relative moves abroad or passes away?

That address goes away. And if I’m not prepared, I risk losing access to my U.S. investment accounts—or being forced to sell and pay capital gains tax unexpectedly.

What a U.S. Brokerage Might Do If You Lose Your Address

U.S. brokerages require you to have a valid U.S. address on file. If they determine that you're no longer a U.S. resident—or that you’ve updated your address to a foreign country—they may:

✅ Restrict new activity in your account. You’ll still own your assets and can sell, but you can’t buy anything new.

⚠️ Freeze account updates, prevent address changes, or require you to transfer your account to another institution.

❌ Force account closure in rare cases, particularly for IRAs or mutual fund-only accounts, potentially triggering capital gains taxes if your assets are sold.

Once you update your address to Japan, it’s very difficult to reverse course.

What I'm Doing to Prepare

I’ve thought a lot about this, and here’s the plan I’m using to make sure I’m not caught off guard.

1. Maintain a Valid U.S. Residential Address

As long as I own or have legal ties to a U.S. address, I can continue using it as my U.S. residence for brokerage and tax purposes.

I’ve backed that up by:

Keeping my driver’s license current at that address

Paying a utility bill

Having financial documents mailed there

Continuing to file state taxes

2. Use a Mail Forwarding Service (If Needed)

If I lose access to my current U.S. address, I’ll start using a reputable mail forwarding service. These services give you a real U.S. street address (not a P.O. Box) and let you receive, scan, and forward mail digitally.

I’ll still need a valid residential address on file with my brokerage, but the forwarding service helps me manage important mail while living abroad—without relying on tenants or distant family.

3. Establish a Backup Brokerage Account

I’ve already opened an account with Interactive Brokers Japan (IBJ), which is expat-friendly and allows a Japan address. I hold the same U.S.-listed ETFs there that I hold in my U.S. account.

If I ever run into trouble with my U.S. brokerage, I have a seamless backup.

Can I Transfer My Holdings Without Paying Capital Gains Tax?

Yes. If I ever need to move my investments from my U.S. brokerage to IBJ, I can do so through an in-kind transfer.

That means:

❌ No capital gains tax (because nothing is sold)

✅ My original cost basis and holding period stay intact

✅ I stay fully invested without disrupting my long-term plan

The process is fairly straightforward—you initiate the transfer from within IBJ, and your shares move as-is from one institution to the other.

Final Thoughts

Being an American investor living in Japan means planning around rules that weren’t built with us in mind. But with some foresight, you can keep your investment strategy on track—without unnecessary taxes or account restrictions.

If you're using a relative’s U.S. address and know it may not be available forever, now is the time to plan. Mail forwarding services, backup brokerage accounts, and maintaining a strong U.S. residency tie can save you a lot of stress down the road.

If you want help evaluating your options or understanding how to do this for yourself, reach out anytime.

Until next time — keep growing your wealth across borders.

– The FI Professor

Disclaimer

This post is for informational and educational purposes only and does not constitute investment, legal, or tax advice. Always consult with a qualified financial advisor or tax professional regarding your specific situation. The views expressed are my own and based on personal experience as a U.S. expat living in Japan.

How I’m Investing in an Uncertain World

Nearly 20 years ago, I arrived in Japan with $5,000 in my pocket from selling a car—and $20,000 in student loan debt. I didn’t know what “financial independence” was. I just knew I was in my late 20s, far from home, and needed to get my financial life together.

One day, I wandered into a bookstore in Osaka that carried foreign-language titles and found The Complete Idiot’s Guide to Getting Rich by Larry Waschka. It wasn’t flashy, but it was full of solid, foundational advice:

Save more than you earn

Pay off high-interest debt

Build an emergency fund

Invest in low-cost index funds

Eventually, expand into real estate and business

That simple framework helped guide me through two decades of investing. And while I’ve added nuance and complexity over the years—especially as an American expat living in Japan—the core principles haven’t changed.

But the world around us has.

The 2025 Reality Check

We’re in a moment that feels increasingly uncertain. The return of Trump-era tariffs is shaking international trade. The stock market is reacting to political instability, inflation pressures, and concerns about rate cuts—or the lack of them. And with geopolitical tensions simmering across multiple regions, the usual noise of the market has gotten louder.

So how do you invest when everything feels like it’s in flux?

You don’t panic. You don’t pull out. You don’t chase shiny objects.

Instead, you focus on what you can control. You make intentional, flexible moves that align with your goals—and your current stage of life.

As someone who is already financially independent, my goal is no longer to build toward FI. It’s to preserve wealth, stay diversified, and maintain liquidity so I can navigate whatever’s next.

Here’s how I’m doing that.

How I Use My Job Income in Japan

My full-time salary from my university job in Japan is stable and predictable, which allows me to be methodical in how I deploy it.

Step 1: Maximize Tax-Advantaged Accounts

Each year, I gift my wife ¥1.1 million to invest in her NISA account. (That’s the annual limit under Japan’s gift tax exclusion for spouses.) She recently hit a milestone—her NISA account crossed ¥10 million. That long-term, tax-free compounding is one of the best wealth-building strategies available to us in Japan.

Step 2: Build and Maintain an Emergency Fund

I keep a modest yen-based emergency fund to cover 3–6 months of expenses. Living in Japan, it’s important to have quick access to yen in the event of unexpected costs, a job transition, or short-term disruptions.

Step 3: Invest the Rest in Taxable Brokerage (Japan)

Once the NISA is funded and the emergency fund is topped off, I invest the remaining income into my Japanese taxable brokerage account. My strategy there is consistent:

30% VOO (U.S. Large Cap)

20% VB (U.S. Small Cap)

20% VXUS (International Developed)

10% VWO (Emerging Markets)

I keep this mix aligned with my U.S.-based taxable investments, with one key difference: it’s all in yen. That gives me currency diversification and future spending flexibility if I stay in Japan long term.

What I Do With My Rental Property Income (U.S.)

My 10 rental properties in the U.S. generate steady cash flow. Here’s how I allocate that income:

1. One-Third to Vanguard Money Market Fund (VMFXX – 4.5% interest)

This is my cash cushion—an opportunity fund that earns solid interest while keeping me nimble. In today’s environment, with rates still high and markets bouncing around, liquidity is a form of defense.

If a great real estate deal comes along or there’s a major market correction, this is where I’ll pull from. It’s dry powder, plain and simple.

2. One-Third to My U.S. Taxable Brokerage Account

This continues to be the long-term growth engine of my portfolio. I stick with what’s worked:

VTI (U.S. total market)

VOO (S&P 500)

VB (Small-cap)

VXUS (International)

VWO (Emerging Markets)

I rebalance once or twice a year, and I don’t try to time the market. This part of my strategy is about staying the course—investing consistently and letting compounding do the heavy lifting.

3. One-Third to Rental Property Debt Paydown

All of my mortgages are at or below 5%. From a strict mathematical ROI standpoint, there’s no rush to pay them off. But from a risk management and lifestyle perspective, I see real value here.

I’m not trying to maximize leverage. I’m already FI, and I care more about stability, simplicity, and cash flow than squeezing out every extra percentage point. Reducing debt improves my net cash flow and strengthens my position if the real estate market softens.

A Hard-Learned Lesson: My Commercial Real Estate Investment

One area where things didn’t go as planned was my commercial real estate investment. A few years ago, I invested in a 19-duplex portfolio in Huntsville, Alabama. On paper, it looked like a great opportunity—scale, strong market, solid returns.

But the reality didn’t match the projections. The deal faced multiple challenges over time—management turnover, cost overruns, shifting market conditions—and I spent years trying to exit the investment.

This year, I finally sold the last duplex in the portfolio and fully exited. It wasn’t a financial win. But it was a learning experience. It reminded me how important transparency, conservative underwriting, and sponsor alignment are in any commercial deal.

Even with that experience, I’m not closing the door on commercial real estate altogether. I still believe in the asset class. But next time, I’ll go in with clearer eyes, better structure, and sharper due diligence.

I’ll write a full post soon on the sale, including:

What went wrong

What I learned

How I’m handling the tax consequences

And what I plan to do with the proceeds

Why This Strategy Works for Me

Everyone’s portfolio is personal. This is what works for me right now, based on where I am in my journey:

I’m already financially independent. That shifts my focus from accumulation to preservation and optionality.

I value simplicity and flexibility. That’s why I don’t day-trade, chase hot trends, or over-complicate things.

I’m diversified across countries, currencies, and asset classes. That helps me weather uncertainty—whether it’s market-related, geopolitical, or personal.

I keep some dry powder. In today’s climate, cash isn’t just king—it’s opportunity fuel.

Final Thoughts: Back to the Basics

It’s easy to get caught up in the headlines—tariffs, elections, inflation, recessions. But the truth is, the future has always been uncertain.

What’s helped me is sticking to a plan, revisiting it periodically, and staying grounded in the basics:

Keep investing

Stay diversified

Manage risk thoughtfully

Don't overreact

When I started out, I was just trying to escape debt. Today, I have a portfolio that gives me the flexibility to live life on my own terms.

And I still believe the same thing I did when I picked up that first finance book in Osaka:

Consistency beats complexity.

How are you navigating the current market? Are you making changes or staying the course? Let me know in the comments.

Disclaimer: This post is for educational purposes only and does not constitute financial or legal advice. Please consult with a qualified financial or tax professional before making any investment decisions, especially regarding U.S. brokerage accounts, international tax treatment, or retirement planning as an expat.

4 Levels of Portfolios: Crafting Your Ideal Early Retirement Strategy

One of my favorite podcasts, BiggerPockets Money, hosted by Scott Trench and Mindy Jensen, dives deep into personal finance, investing, and achieving financial independence. If you're unfamiliar, BiggerPockets Money is a spin-off from the larger BiggerPockets brand, which primarily focuses on real estate investing. However, Scott and Mindy’s show casts a wider net, covering everything from budgeting and saving strategies to investment diversification and early retirement. They frequently bring on expert guests and real-life investors to explore how different financial strategies play out in the real world.

In a recent episode, Scott and Mindy discussed an intriguing question: "How would you allocate a hypothetical $1.5 million portfolio for someone looking to retire early?" This question stuck with me, and I started thinking about how I’d approach it, especially if I were advising a 35-year-old friend who lives on around $50,000 a year and is ready to retire now.

So, I’ve crafted four portfolio scenarios, each with varying levels of complexity and activity. Whether you're looking for something super passive or you're eager to stay engaged in the investing world, there's an approach here that might resonate with you.

1. The Super Simple Portfolio

* For the investor who wants a completely hands-off, passive approach.

Cash ($50,000): 100% in a High-Interest Savings Account

ETFs ($1,450,000):

50% US Total Stock Market Fund

15% US Small Cap Fund

15% International Fund

10% Emerging Markets Fund

10% Bond Fund

Estimated Income: $58,000/year (based on the 4% rule applied to the ETF portfolio)

This portfolio is as easy as it gets—minimal management, broad diversification, and a steady income stream that should comfortably cover living expenses.

2. The Simple Portfolio

* For the investor who wants to add a little real estate to their passive portfolio without too much complexity.

Cash ($50,000): 100% in a High-Interest Savings Account

ETFs ($1,000,000):

50% US Total Stock Market Fund

15% US Small Cap Fund

15% International Fund

10% Emerging Markets Fund

10% Bond Fund

Real Estate ($450,000):

100% in Single-Family Homes in Hybrid Markets, Leveraged at 75% (balancing cash flow and appreciation)

Estimated Income: $67,000/year

(This combines the 4% rule for the ETF portfolio and a 6% cash-on-cash return for the real estate portfolio. It doesn’t factor in appreciation, debt paydown, or tax benefits from real estate.)

This approach introduces real estate to the mix, offering more diversified income streams and potential tax advantages.

3. Simple Plus Portfolio

For the investor seeking more diversification with a taste for higher-risk, higher-reward opportunities.

Cash ($50,000):

60% High-Interest Savings Account

20% Gold

20% Crypto (mainly Bitcoin and Ethereum with a small allocation to ALT coins)

ETFs ($1,000,000):

50% US Total Stock Market Fund

15% US Small Cap Fund

15% International Fund

10% Emerging Markets Fund

10% Bond Fund

Real Estate ($450,000):

60% in Single-Family Homes in Hybrid Markets, Leveraged at 75%

40% in Commercial Syndications (multi-family, self-storage, industrial, etc.)

Estimated Income: $67,000/year

(The income remains consistent, but the potential for outsized returns increases with crypto and syndications. For example, I recently exited two syndication deals that delivered a 100% return in just two years.)

This portfolio is ideal for those comfortable with moderate risk and looking for both steady income and potential big wins.

4. The "I’m Not Really Ready to Retire" Portfolio

* For the investor who claims they want to retire but still have the entrepreneurial itch.

Cash ($100,000):

60% High-Interest Savings Account

20% Gold

20% Crypto (mainly Bitcoin and Ethereum with a small allocation to ALT coins)

ETFs ($1,000,000):

50% US Total Stock Market Fund

15% US Small Cap Fund

15% International Fund

10% Emerging Markets Fund

10% Bond Fund

Real Estate ($350,000):

60% in Single-Family Homes in Hybrid Markets, Leveraged at 75%

40% in Commercial Syndications (multi-family, self-storage, industrial, etc.)

Business ($100,000):

Invest in or acquire small, cash-flowing businesses using techniques popularized by entrepreneurs like Cody Sanchez. Think laundromats, car washes, or lawn care businesses. Alternatively, start a short-term rental business through property acquisition or rental arbitrage.

Estimated Income: Unlimited

This portfolio is perfect for someone who wants financial independence but still craves the excitement of business ventures and active income generation.

Which Portfolio is Right for You?

Your ideal portfolio depends on your risk tolerance, desired involvement level, and long-term goals. Whether you're looking for simplicity, a balanced approach, or a more active investment strategy, the key is to create a diversified portfolio that supports your lifestyle and financial independence journey.

If you haven’t already, I highly recommend checking out BiggerPockets Money for more insights like this. Scott and Mindy do a fantastic job of breaking down complex financial topics into relatable, actionable advice. Their podcast has inspired many of my own strategies—maybe it’ll spark some ideas for you, too!

So, what’s your ideal portfolio? Let me know in the comments!

Disclaimer

This article is for educational purposes only and does not constitute financial or legal advice. Please consult a certified financial planner or tax professional before making investment decisions, especially concerning U.S. residency requirements, PFIC reporting, and cross-border retirement contributions. Always conduct thorough due diligence.

What’s in The FI Professor’s Portfolio?

Almost 20 years ago, when I came to Japan, I brought with me about $5,000 from selling a car—but also $20,000 in student loan debt. However, I knew I needed to make a change. I was in my late 20s and had to get my finances together.

I went to a bookstore in Osaka that carried foreign titles and picked up The Complete Idiot’s Guide to Getting Rich by Larry Waschka. This was before the FIRE movement and before the endless stream of financial content through podcasts, YouTube, and social media. But the advice from that book was simple and effective:

Save more than you earn.

Pay off high-interest debt.

Build an emergency fund.

Invest in low-cost index funds.

Eventually, expand into real estate and business.

This advice carried me through my entire investing career. I quickly learned, however, that the rules are a little different for American expats in Japan. Even with these challenges, I was able to become financially free within 15 years of moving here.

So, what’s in my portfolio today? Let’s take a deep dive.

The FI Professor’s Portfolio Breakdown

My portfolio is heavily weighted toward the U.S. (85%), with Japan making up 15%. The structure focuses on index investing for long-term market exposure, real estate for cash flow and appreciation, and a small allocation to crypto.

Overall Allocation:

Cash (5%)

Index Funds (37%)

Cryptocurrency (1%)

Personal Residence (9%)

Residential Real Estate Investments (44%)

Commercial Real Estate Investments (4%)

U.S. Portfolio (85% of total networth)

Cash (5% of U.S. Portfolio)

I hold high-yield savings accounts (HYSA) and checking accounts in the U.S. While I generally prefer to stay fully invested, I keep some cash liquidity for real estate purchases, market dips, and emergencies.

Index Funds (40% of U.S. Portfolio)

My U.S. index fund allocation follows a high-growth, diversified strategy:

20% VTI (U.S. Broad Market) – Covers the entire U.S. stock market.

30% VOO (U.S. Large Cap) – Focuses on the S&P 500.

20% VB (U.S. Small Cap) – Provides exposure to smaller, high-growth companies.

20% VXUS (International Stocks) – Diversifies into developed and emerging markets.

10% VWO (Emerging Markets) – Focuses on high-growth economies like China, India, and Brazil.

Cryptocurrency (1% of U.S. Portfolio)

Crypto is a small, high-risk, high-reward part of my portfolio:

70% Bitcoin – The most established and widely adopted cryptocurrency.

10% Ethereum – The backbone of decentralized finance (DeFi).

10% Altcoins – A mix of smaller, speculative crypto projects.

Residential Real Estate Investments (50% of U.S. Portfolio)

Real estate plays a major role in my U.S. portfolio, providing cash flow and long-term appreciation. I calculate my equity in the portfolio by subtracting the debt from the value of the properties. I own:

2 single-family homes in Caldwell, ID

6 single-family homes in Memphis, TN

1 single-family home in Fultondale, AL

1 duplex in Toney, AL

Commercial Real Estate Investments (4% of U.S. Portfolio)

I currently hold equity in a 19-duplex portfolio in Huntsville, AL. This investment will be sold in early 2025, and I will decide whether to reinvest in new syndications or allocate the proceeds elsewhere.

Japan Portfolio (15% of total networth)

Cash (15% of Japan Portfolio)

I hold Japanese yen in multiple bank accounts to cover living expenses and potential real estate purchases in Japan. Since I live here, it makes sense to keep a portion of my net worth liquid in yen.

Index Funds (30% of Japan Portfolio)

My Japanese investments include tax-advantaged accounts (DC Plan and NISA) and a taxable brokerage.

DC Plan (Retirement Account)

50% International Stocks (三井住友・DC外国株式インデックスファンドS)

20% Japan Stocks (三井住友・DCつみたてNISA・日本株インデックスファンド)

10% Emerging Market Stocks (インデックスファンド海外新興国(エマージング)株式)

10% International Bonds (三井住友・DC外国債券インデックスファンドS)

5% Emerging Market Bonds (DCダイワ新興国債券インデックスファンド)

5% Japan Bonds (三菱UFJ国内債券インデックスファンド(確定拠出年金))

NISA (Tax-Free Investment Account)

100% eMAXIS Slim 全世界株式(オール・カントリー) – A globally diversified all-world index fund.

Taxable Brokerage (Japan)

My Japanese taxable investments mirror my U.S. allocation:

30% VOO (U.S. Large Cap)

20% VB (U.S. Small Cap)

20% VXUS (International Stocks)

10% VWO (Emerging Markets)

Personal Residence (55% of Japan Portfolio)

I own a condo in Kusatsu, Shiga, which serves as my primary residence. While I don’t consider personal real estate an investment, it still represents a portion of my overall net worth. This property has no mortgage.

Residential Real Estate Investments (TBD%)

I am currently exploring rental property opportunities in Japan, particularly single-family homes (akiya) that need minor renovations. These properties will be located just outside major population centers in Kansai and will be within 15 minutes of a train station.

Why This Portfolio Works for Me

This portfolio provides a balance between growth, cash flow, and stability:

Index funds ensure long-term market exposure and growth.

Real estate provides cash flow and appreciation.

Cash reserves offer liquidity and flexibility.

Crypto is a small but high-risk/high-reward allocation.

For me, financial independence is about options. With this portfolio, I have the flexibility to continue working, travel, invest in new opportunities, or simply enjoy life on my terms.

Final Thoughts

When I started my financial journey two decades ago, I had more debt than assets. Today, my portfolio allows me to live life on my own terms while preparing for the future. The key lessons I’ve learned along the way?

Consistency beats complexity – Automate savings and investments.

Diversification is crucial – Spread risk across asset classes and geographies.

Real estate can be a game-changer – But it requires careful planning.

Personal finance is personal – Your ideal portfolio depends on your goals.

Whether you’re just starting out or refining your own portfolio, I hope this breakdown provides some useful insights.

What does your ideal portfolio look like? Let me know in the comments!

Disclaimer

This article is for educational purposes only and does not constitute financial or legal advice. Please consult a certified financial planner or tax professional before making investment decisions, especially concerning U.S. residency requirements for bank and brokerage accounts, as this is a grey area and may have legal implications. Always conduct thorough due diligence.

Simplifying Tax Season: How I Organize My Documents

Tax season can feel overwhelming, but having an organized system makes it much easier to manage. In this post, I’ll share the system I use to keep all my tax-related documents tidy, accessible, and ready for my accountant. I’ve included examples for different types of documents and assets and screenshots of my folder structure to help you visualize how it works. At the end, I’ll show you how to create a simple spreadsheet to guide your accountant through your files.

Step 1: The Folder Structure

I use Google Drive to store and organize all my tax documents. Each year has its own folder (e.g., "2024 Tax Documents Daniel"), and within that folder, I create subfolders for different categories:

Banks and Brokerages

Personal Real Estate Portfolio

Commercial Real Estate and Syndications

Work

Each subfolder is further divided based on document type. For example, under "Personal Real Estate Portfolio," I’ll have folders for:

City/County Taxes

Income Statements

Insurance

Mortgage 1098s

Property Management 1099s

This setup ensures that every document has a clear home. Take a look at the screenshots of my Google Drive for a visual example of how this is organized.

Image 1: Folder Setup in my Google Drive

Image 2: Folders in my 2024 Tax Folder

Image 3: Subfolders in my Personal Real Estate folder

Step 2: Naming Documents

A consistent naming system is key. Each document is named in a way that makes it instantly identifiable. Here’s how I structure names:

Banks and Brokerages:

Format:

Bank/Brokerage_Name_1099_Year_OwnerExample:

Ally_1099_2024_Daniel

Personal Real Estate Portfolio:

Income Statement:

Property_Name_Income_Statement_YearExample:

BlueRidge_Income_Statement_2024

Mortgage 1098:

Property_Name_Mortgage_Provider_1098_YearExample:

BlueRidge_Rushmore_1098_2024

Property Taxes:

City/County_Taxes_Year_Property_Name_Tax_AgencyExample:

Memphis_City_Taxes_2024_Redvers_Debby_Aden_SpringShadow

Commercial Real Estate and Syndications:

K-1 Statements:

Entity_Name_K1_YearExample:

GPCMAlabamaLLC_K1_2024

Work:

Tax Documents (Japan):

Gensen_Name_YearExample:

Gensen_Daniel_2024

By using this naming system, I can quickly locate any document when needed.

Step 3: Providing Context for Your Accountant

To make life even easier for my accountant, I create a spreadsheet that acts as a roadmap to my folders. Here’s how it’s structured:

Image 4: Tax Document Roadmap

This spreadsheet ensures that my accountant knows exactly where to find each file. It’s also a great reference for me when I’m double-checking my files before submission.

Step 4: Keeping It Up-to-Date

Organization isn’t a one-time task; it’s an ongoing process. Whenever a new document arrives, I:

Save it to the correct folder immediately.

Name it according to the system.

Update the spreadsheet with its location.

Final Thoughts

Tax season doesn’t have to be stressful. With an organized folder structure, a consistent naming system, and a detailed spreadsheet for your accountant, you’ll save time and headaches. Take a look at the provided screenshots for inspiration, and start building your own system today. If you have any questions or tips for organizing tax documents, let me know in the comments below!

Disclaimer

This article is for educational purposes only and does not constitute financial or legal advice. Please consult a certified financial planner or tax professional before making investment decisions, especially concerning U.S. residency requirements, PFIC reporting, and cross-border retirement contributions. Always conduct thorough due diligence.

Investing for Americans in Japan: A Step-by-Step Guide to Building Wealth Across Borders

It all begins with an idea.

Updated December 28, 2025

For Americans living in Japan, investing can seem like navigating a financial maze. From understanding the complexities of Passive Foreign Investment Companies (PFICs)—a classification that comes with punitive taxes to discourage passive investments in foreign entities and funds—to deciding where to save and invest, the process can be challenging but rewarding. This guide will break down the steps to help you build wealth while ensuring compliance with both U.S. and Japanese financial systems.

Step 1: Save More Than You Spend

Before investing, you need to master saving. If you aren’t saving money yet, implement one or more of these strategies:

Budgeting:

Track Your Spending: Monitor your expenses for at least 30 days to identify areas where you can cut back. Continue tracking until you have spending under control.

Pay Yourself First: Open two bank accounts and deposit your planned savings into a separate account as soon as your paycheck arrives. Spend only what remains in the primary account. This approach requires a general understanding of your monthly expenses.

Earn More Money:

Take on part-time work or start a side hustle.

Use tools like ChatGPT for business advice and growth strategies.

If applicable, consider upskilling or pursuing education to increase your income, but evaluate the return on investment (ROI) to avoid unnecessary debt or delays in retirement.

Step 2: Save a Small Emergency Fund

Ensure you have at least ¥100,000 saved for small emergencies before moving forward. This safety net prevents unexpected expenses from derailing your progress.

Step 3: Pay Off High-Interest Debt

Focus on eliminating debt with interest rates higher than 6%. While investments may offer higher returns, paying off high-interest debt is a guaranteed way to improve your financial situation.

Step 4: Decide Where to Hold Your Money

As an American living in Japan, you’ll need to decide whether to keep your assets in Japan, the U.S., or both. Each option has pros and cons.

In Japan, your money is accessible in the local currency and aligned with your lifestyle. In the U.S., you have access to low-cost, globally diversified investments and potentially better long-term returns in dollars. Holding assets in both countries gives you flexibility in retirement, can help with currency diversification, and may even offer a layer of asset protection.

📌 For a deeper look at this strategy, check out my blog: Why I Love Having Assets in Both the U.S. and Japan.

To maintain U.S. brokerage accounts, you’ll typically need a valid U.S. mailing address. Some people continue using a family member’s home, while others rely on virtual mailboxes. Just be aware that using a virtual mailbox may eventually violate brokerage terms of service if not handled carefully.

📌 I explore this issue more in What Happens to My U.S. Brokerage Account If I Lose My U.S. Address?

As an American, you need to decide whether to keep your assets in Japan, the U.S., or both. Each option has pros and cons:

In Japan: Provides easy access to local currency and aligns with residency.

In the U.S.: Keeping assets in the U.S. can allow you to collateralize loans for purposes like real estate or business investments. Additionally, it enables you to earn returns in dollars, which currently hold more purchasing power compared to the yen.

Holding assets in both locations allows you in retirement to live for extended periods of time in both countries and may provide a form of asset protection as it is difficult for lawsuits to claim assets in a country where they didn't originate.

To maintain U.S. bank and brokerage accounts, you’ll generally need a U.S. address. Options include:

Keeping a U.S. driver’s license and paying bills at that address.

Using virtual mailboxes (note: many institutions require a physical address).

This is a grey area, so consult a financial professional to ensure compliance.

Step 5: Build a Full Emergency Fund

Aim to save 3-6 months of living expenses. For business owners or those with variable income, 12 months may be safer.

In Japan: Save in a standard bank account for easy access during emergencies.

In the U.S.: Use a high-yield savings account (e.g., Ally Bank currently offers 3.3% APY).

Step 6: Invest in Equities and Bonds

Now that your emergency fund is in place, it’s time to invest. But keep in mind—what follows is not an “order of operations.” These are options. Pick and choose the ones that fit your situation and goals. Your ideal mix will depend on your income level, tax residency, and long-term plan.

1. Open a Growth (Seichō) NISA through Interactive Brokers

One important update since I originally wrote this post is the availability of the Growth (Seichō) NISA for U.S. citizens through Interactive Brokers Japan.

Historically, NISA accounts were difficult for Americans to use because most Japanese mutual funds and ETFs are classified as Passive Foreign Investment Companies (PFICs) under U.S. tax law, which comes with heavy reporting requirements and often punitive taxation. However, Interactive Brokers allows Americans to open a Growth NISA and invest in U.S.-domiciled ETFs, which are not PFICs.

This means Americans can now use Growth NISA to invest in familiar funds such as:

GLD

QQQ

SPY

SPYD

VOO

VT

VTI

VXUS

Because these ETFs are U.S.-domiciled, they are treated from a U.S. tax perspective the same way they would be if held in a regular U.S. brokerage account, while still benefiting from Japan’s NISA tax treatment on the Japanese side.

For many Americans living in Japan, this has become one of the cleanest and most straightforward ways to invest in equities locally without triggering PFIC issues.

2. Leverage Your Japanese Spouse’s NISA and iDeCo Accounts

If your spouse is a Japanese citizen and not a U.S. taxpayer, you can gift up to ¥1.1 million per year to them without triggering Japanese gift tax. This money can be invested into their NISA or iDeCo account—two of Japan’s best tax-advantaged vehicles. Since they aren’t U.S. persons, PFIC rules don’t apply to them, making these accounts a powerful tool for your household’s overall investment strategy.

3. Use a DC Plan and iDeCo Together (or iDeCo Alone if No DC Plan Is Offered)

If your employer offers a corporate DC (Defined Contribution) pension plan, it’s something you should look at carefully. These plans are tax-advantaged in Japan and are often treated as pension plans rather than simple investment accounts.

That said, it’s important to be very clear here: there is no universal consensus among U.S. CPAs that DC Plans or iDeCo accounts are fully exempt from PFIC rules when they hold mutual funds or similar investments. Some CPAs who specialize in U.S. expats in Japan believe these accounts qualify for PFIC exemptions under pension rules (often referencing IRS Regulation 1.1298-1(c)(4)). Others strongly disagree.

The most conservative and safest approach for Americans who want to avoid PFIC risk entirely is to:

Use DC Plans and iDeCo as cash-only accounts, or

Avoid investing in mutual funds or pooled investment products inside these accounts

Before investing in equities or funds within a DC Plan or iDeCo, you should talk this through with your CPA and make sure you are comfortable with the tax position being taken on your return.

In terms of contribution limits, Japan has been increasing the amounts that can be contributed, although the rollout is gradual. Under current and upcoming rules:

Employees will generally be able to contribute up to approximately ¥62,000 per month combined across DC Plans and iDeCo

If your company does not offer a DC Plan, iDeCo limits for employees are expected to rise toward the same level

Some categories, such as self-employed individuals, may eventually be able to contribute up to around ¥75,000 per month

These higher limits make DC Plans and iDeCo more attractive from a Japanese perspective, but because the U.S. tax treatment is not fully settled, caution is still warranted.

4. Use Growth NISA with Individual Japanese Stocks (PFIC-Free)

Most Japanese investment funds and ETFs are PFICs, which carry heavy reporting and punitive taxation under U.S. law. However, individual Japanese stocks are not PFICs. That means you can use the Growth NISA (the only portion accessible to U.S. persons) to invest in single stocks like Toyota, Sony, or Nintendo.

This strategy only makes sense if:

You stick to individual stocks, not funds

You’re confident holding these long-term

The NISA allocation is a small part of your overall portfolio (for example, you invest ¥20 million or more annually and want to use NISA as a small tax-advantaged carve-out)

5. Open a Taxable Brokerage Account

The best way to invest for long-term growth is often through a taxable brokerage account that allows you to buy U.S.-domiciled ETFs like VTI, VXUS, and BND. These avoid PFIC rules and offer global diversification at low cost.

There are two common ways Americans living in Japan do this.

One option is to use a U.S.-based brokerage such as Fidelity or Vanguard while maintaining a U.S. mailing address. This can work well if you have a permanent address and phone number in the U.S., but it remains a gray area. Accounts may be restricted if the brokerage determines that you are living abroad.

Another option is to open a taxable brokerage account with Interactive Brokers Japan. Interactive Brokers allows U.S. citizens living in Japan to open accounts using their Japanese address and invest directly in U.S.-domiciled ETFs. From a U.S. tax perspective, this is treated the same as holding these ETFs through a U.S. brokerage account, allowing you to avoid PFIC issues while remaining fully compliant with address and residency requirements.