Investing for Americans in Japan: A Step-by-Step Guide to Building Wealth Across Borders

Updated December 28, 2025

For Americans living in Japan, investing can seem like navigating a financial maze. From understanding the complexities of Passive Foreign Investment Companies (PFICs)—a classification that comes with punitive taxes to discourage passive investments in foreign entities and funds—to deciding where to save and invest, the process can be challenging but rewarding. This guide will break down the steps to help you build wealth while ensuring compliance with both U.S. and Japanese financial systems.

Step 1: Save More Than You Spend

Before investing, you need to master saving. If you aren’t saving money yet, implement one or more of these strategies:

Budgeting:

Track Your Spending: Monitor your expenses for at least 30 days to identify areas where you can cut back. Continue tracking until you have spending under control.

Pay Yourself First: Open two bank accounts and deposit your planned savings into a separate account as soon as your paycheck arrives. Spend only what remains in the primary account. This approach requires a general understanding of your monthly expenses.

Earn More Money:

Take on part-time work or start a side hustle.

Use tools like ChatGPT for business advice and growth strategies.

If applicable, consider upskilling or pursuing education to increase your income, but evaluate the return on investment (ROI) to avoid unnecessary debt or delays in retirement.

Step 2: Save a Small Emergency Fund

Ensure you have at least ¥100,000 saved for small emergencies before moving forward. This safety net prevents unexpected expenses from derailing your progress.

Step 3: Pay Off High-Interest Debt

Focus on eliminating debt with interest rates higher than 6%. While investments may offer higher returns, paying off high-interest debt is a guaranteed way to improve your financial situation.

Step 4: Decide Where to Hold Your Money

As an American living in Japan, you’ll need to decide whether to keep your assets in Japan, the U.S., or both. Each option has pros and cons.

In Japan, your money is accessible in the local currency and aligned with your lifestyle. In the U.S., you have access to low-cost, globally diversified investments and potentially better long-term returns in dollars. Holding assets in both countries gives you flexibility in retirement, can help with currency diversification, and may even offer a layer of asset protection.

📌 For a deeper look at this strategy, check out my blog: Why I Love Having Assets in Both the U.S. and Japan.

To maintain U.S. brokerage accounts, you’ll typically need a valid U.S. mailing address. Some people continue using a family member’s home, while others rely on virtual mailboxes. Just be aware that using a virtual mailbox may eventually violate brokerage terms of service if not handled carefully.

📌 I explore this issue more in What Happens to My U.S. Brokerage Account If I Lose My U.S. Address?

As an American, you need to decide whether to keep your assets in Japan, the U.S., or both. Each option has pros and cons:

In Japan: Provides easy access to local currency and aligns with residency.

In the U.S.: Keeping assets in the U.S. can allow you to collateralize loans for purposes like real estate or business investments. Additionally, it enables you to earn returns in dollars, which currently hold more purchasing power compared to the yen.

Holding assets in both locations allows you in retirement to live for extended periods of time in both countries and may provide a form of asset protection as it is difficult for lawsuits to claim assets in a country where they didn't originate.

To maintain U.S. bank and brokerage accounts, you’ll generally need a U.S. address. Options include:

Keeping a U.S. driver’s license and paying bills at that address.

Using virtual mailboxes (note: many institutions require a physical address).

This is a grey area, so consult a financial professional to ensure compliance.

Step 5: Build a Full Emergency Fund

Aim to save 3-6 months of living expenses. For business owners or those with variable income, 12 months may be safer.

In Japan: Save in a standard bank account for easy access during emergencies.

In the U.S.: Use a high-yield savings account (e.g., Ally Bank currently offers 3.3% APY).

Step 6: Invest in Equities and Bonds

Now that your emergency fund is in place, it’s time to invest. But keep in mind—what follows is not an “order of operations.” These are options. Pick and choose the ones that fit your situation and goals. Your ideal mix will depend on your income level, tax residency, and long-term plan.

1. Open a Growth (Seichō) NISA through Interactive Brokers

One important update since I originally wrote this post is the availability of the Growth (Seichō) NISA for U.S. citizens through Interactive Brokers Japan.

Historically, NISA accounts were difficult for Americans to use because most Japanese mutual funds and ETFs are classified as Passive Foreign Investment Companies (PFICs) under U.S. tax law, which comes with heavy reporting requirements and often punitive taxation. However, Interactive Brokers allows Americans to open a Growth NISA and invest in U.S.-domiciled ETFs, which are not PFICs.

This means Americans can now use Growth NISA to invest in familiar funds such as:

GLD

QQQ

SPY

SPYD

VOO

VT

VTI

VXUS

Because these ETFs are U.S.-domiciled, they are treated from a U.S. tax perspective the same way they would be if held in a regular U.S. brokerage account, while still benefiting from Japan’s NISA tax treatment on the Japanese side.

For many Americans living in Japan, this has become one of the cleanest and most straightforward ways to invest in equities locally without triggering PFIC issues.

2. Leverage Your Japanese Spouse’s NISA and iDeCo Accounts

If your spouse is a Japanese citizen and not a U.S. taxpayer, you can gift up to ¥1.1 million per year to them without triggering Japanese gift tax. This money can be invested into their NISA or iDeCo account—two of Japan’s best tax-advantaged vehicles. Since they aren’t U.S. persons, PFIC rules don’t apply to them, making these accounts a powerful tool for your household’s overall investment strategy.

3. Use a DC Plan and iDeCo Together (or iDeCo Alone if No DC Plan Is Offered)

If your employer offers a corporate DC (Defined Contribution) pension plan, it’s something you should look at carefully. These plans are tax-advantaged in Japan and are often treated as pension plans rather than simple investment accounts.

That said, it’s important to be very clear here: there is no universal consensus among U.S. CPAs that DC Plans or iDeCo accounts are fully exempt from PFIC rules when they hold mutual funds or similar investments. Some CPAs who specialize in U.S. expats in Japan believe these accounts qualify for PFIC exemptions under pension rules (often referencing IRS Regulation 1.1298-1(c)(4)). Others strongly disagree.

The most conservative and safest approach for Americans who want to avoid PFIC risk entirely is to:

Use DC Plans and iDeCo as cash-only accounts, or

Avoid investing in mutual funds or pooled investment products inside these accounts

Before investing in equities or funds within a DC Plan or iDeCo, you should talk this through with your CPA and make sure you are comfortable with the tax position being taken on your return.

In terms of contribution limits, Japan has been increasing the amounts that can be contributed, although the rollout is gradual. Under current and upcoming rules:

Employees will generally be able to contribute up to approximately ¥62,000 per month combined across DC Plans and iDeCo

If your company does not offer a DC Plan, iDeCo limits for employees are expected to rise toward the same level

Some categories, such as self-employed individuals, may eventually be able to contribute up to around ¥75,000 per month

These higher limits make DC Plans and iDeCo more attractive from a Japanese perspective, but because the U.S. tax treatment is not fully settled, caution is still warranted.

4. Use Growth NISA with Individual Japanese Stocks (PFIC-Free)

Most Japanese investment funds and ETFs are PFICs, which carry heavy reporting and punitive taxation under U.S. law. However, individual Japanese stocks are not PFICs. That means you can use the Growth NISA (the only portion accessible to U.S. persons) to invest in single stocks like Toyota, Sony, or Nintendo.

This strategy only makes sense if:

You stick to individual stocks, not funds

You’re confident holding these long-term

The NISA allocation is a small part of your overall portfolio (for example, you invest ¥20 million or more annually and want to use NISA as a small tax-advantaged carve-out)

5. Open a Taxable Brokerage Account

The best way to invest for long-term growth is often through a taxable brokerage account that allows you to buy U.S.-domiciled ETFs like VTI, VXUS, and BND. These avoid PFIC rules and offer global diversification at low cost.

There are two common ways Americans living in Japan do this.

One option is to use a U.S.-based brokerage such as Fidelity or Vanguard while maintaining a U.S. mailing address. This can work well if you have a permanent address and phone number in the U.S., but it remains a gray area. Accounts may be restricted if the brokerage determines that you are living abroad.

Another option is to open a taxable brokerage account with Interactive Brokers Japan. Interactive Brokers allows U.S. citizens living in Japan to open accounts using their Japanese address and invest directly in U.S.-domiciled ETFs. From a U.S. tax perspective, this is treated the same as holding these ETFs through a U.S. brokerage account, allowing you to avoid PFIC issues while remaining fully compliant with address and residency requirements.

For many Americans in Japan, Interactive Brokers Japan offers a clean and practical long-term solution for taxable investing.If you already have a domestic Schwab account, contact Schwab International before changing your address—they may be able to migrate your account without closing it.

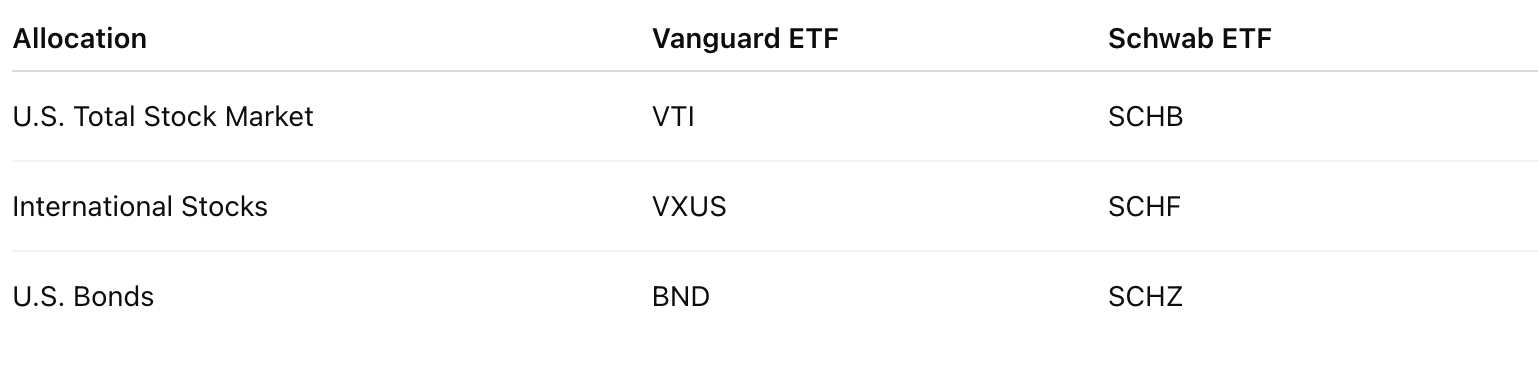

6. Recommended Portfolio

If you’re just getting started, one of the simplest and most effective ways to invest is with a three-fund portfolio. It offers broad diversification, low fees, and long-term growth across the global economy. With just three ETFs, you get exposure to:

U.S. stocks

International stocks

U.S. bonds

You can adjust the percentages to match your personal goals, but a common starting point is:

50% U.S. stocks

25% international stocks

25% bonds

This portfolio is easy to automate, rebalance, and hold for the long term. Once you’ve set it up through a U.S. brokerage account, you can focus on staying the course.

📌 For a full breakdown of how I personally invest, check out What’s in the FI Professor’s Portfolio?

Step 7: Explore Real Estate and Business Opportunities

If retirement accounts aren’t accessible due to the FEIE, real estate and small business income can offer a powerful path forward.

In the U.S., buying rental properties gives you access to leverage and U.S.-sourced income that isn’t affected by FEIE limits. Business income from an LLC or freelance work may also count as earned income for IRA contributions—assuming it’s properly sourced and taxed in the U.S.

These options require more planning, but they’re excellent ways to grow wealth while living abroad.Final Thoughts

Investing as an American in Japan requires strategic planning and adherence to both countries' financial rules. By following these steps and consulting professionals, you can build a robust portfolio that aligns with your lifestyle and retirement goals.

Final Thoughts

Investing as an American in Japan takes thought and intentionality, but it’s absolutely doable. Avoiding PFICs and understanding cross-border tax rules are key. By combining Japanese pension accounts, U.S.-based brokerage platforms, and clear strategies like gifting to your spouse or using Schwab International, you can build a flexible and efficient investment plan.

Stay Connected and Take the Next Step

Ready to take control of your financial future? Follow me on Instagram @TheFIProfessor for expert insights and practical tips on investing and financial independence. Whether you're navigating life as an expat or planning your next steps, let me help you succeed.

If you’re looking for a dynamic speaker or personalized coaching, reach out through my website today—your journey to financial freedom starts here!

Disclaimer

This article is for educational purposes only and does not constitute financial or legal advice. Please consult a certified financial planner or tax professional before making investment decisions, especially concerning U.S. residency requirements, PFIC reporting, and cross-border retirement contributions. Always conduct thorough due diligence.