What We Can Learn from TIGER 21’s Asset Allocation

One of the most interesting things about building wealth is that there isn’t just one “right” way to do it. The choices we make depend on our goals, experiences, and tolerance for risk. Still, it can be helpful to look at what the ultra-wealthy are doing with their money to see if there are lessons we can apply to our own financial journeys.

Recently, I came across the latest asset allocation report from TIGER 21, a private network of ultra-high-net-worth individuals. Their portfolios look very different from what most of us are used to—and it made me think about how my own portfolio stacks up against theirs.

👉 You can get the full report here: TIGER 21 Asset Allocation Report Q2 2025

What Is TIGER 21?

TIGER 21 (The Investment Group for Enhanced Results in the 21st Century) is a global, invitation-only network of more than 1,400 members, each with at least $20 million in investable assets. Members include entrepreneurs, executives, and investors who meet regularly in small groups to share candid advice and feedback on how they manage their wealth.

One of the unique features of TIGER 21 is the “Portfolio Defense.” In these sessions, a member presents their complete financial picture—assets, liabilities, income, and expenses—for constructive critique from peers. The aggregated results form the basis of the quarterly Asset Allocation Report.

In other words: TIGER 21 gives us a rare, behind-the-curtain look at how some of the world’s wealthiest individuals are structuring their money.

TIGER 21’s Latest Allocation (Q4 2024)

Here’s how members allocated their wealth on average:

Private Equity: 28%

Real Estate: 28%

Public Equities: 23%

Cash & Equivalents: 9%

Fixed Income: 7%

Hedge Funds: 2%

Currencies, Commodities, Miscellaneous: ~3% combined

That means more than half their wealth is in alternatives—private equity and real estate—while still maintaining significant liquidity (cash and bonds) and exposure to public markets.

My Current Portfolio

Now, let’s compare this to my own allocation as of mid-2025:

Real Estate (Residential): ~58%

Public Equities (U.S. & Japan): ~42%

Includes ~1% cryptocurrency

Includes a small percentage of bonds within my Japanese DC plan

Cash: ~4%

Private Equity / Alternatives: 0%

Like TIGER 21 members, I lean heavily on real estate. It’s the backbone of my cash flow and a space I know well. But compared to TIGER 21’s average, I’m overweight in property and underweight in liquidity and diversification.

Lessons from TIGER 21

So, what does this comparison suggest? Here are a few takeaways I’m considering for my own strategy:

1. Rebalance Real Estate Exposure

TIGER 21 members keep real estate at around 28%, while I’m closer to 58%. That’s fine for now since real estate produces strong cash flow for me, but over time I may want to trim or refinance to reduce concentration and free up capital for other opportunities.

2. Increase Liquidity

At just 4% in cash, I’m well below TIGER 21’s 9% allocation. Boosting this to 8–10% would give me flexibility—especially as I prepare for my sabbatical in the U.S. (2026–27) and look at new investment opportunities.

3. Add Stability Through Fixed Income

I have only limited bond exposure through my Japanese retirement account. Allocating even 5–7% more directly to U.S. Treasuries or JPY bond ETFs could add stability and predictable income.

4. Consider Alternatives

Private equity makes up nearly a third of TIGER 21’s allocation. While I don’t need to jump into that level, carving out 5–7% for carefully chosen syndications, funds, or business investments could diversify returns without overwhelming the portfolio.

5. Maintain Strong Equity Exposure

At 42%, I’m above TIGER 21’s 23% in public equities. That’s actually a strength for me—liquid, globally diversified investments are a good counterbalance to my real estate holdings.

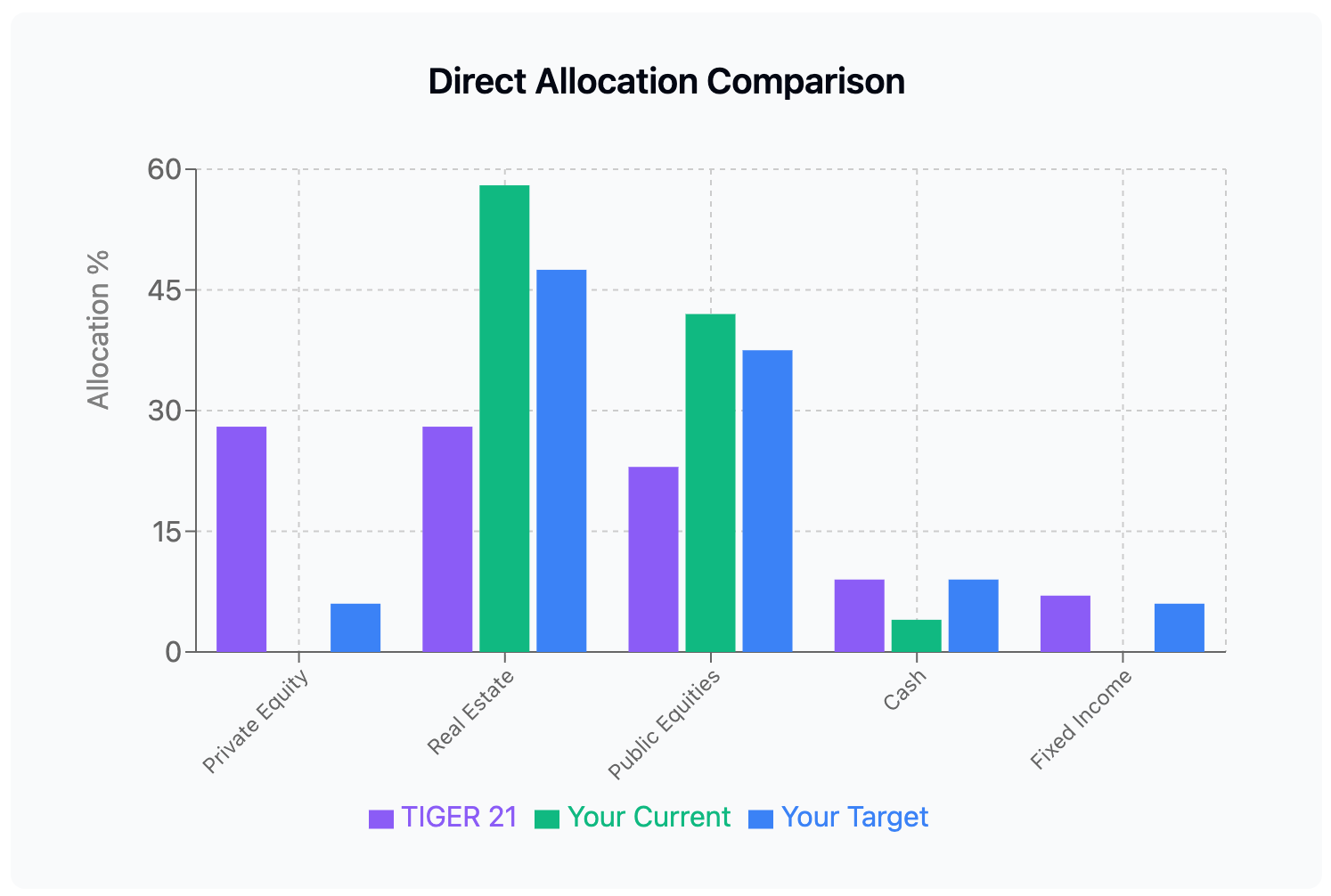

A Possible Restructured Allocation

Here’s a medium-term target allocation that blends my current reality with lessons from TIGER 21:

Real Estate: 45–50%

Public Equities (incl. crypto + bonds): 35–40%

Cash: 8–10%

Fixed Income: 5–7%

Private Equity / Alternatives: 5–7%

This mix still leans on real estate as my foundation but adds more liquidity, stability, and optionality—important as I transition toward financial independence. Here’s a side-by-side look at how TIGER 21 members allocate their wealth, how my portfolio is structured today, and what it could look like after a strategic rebalance.

Connecting Back to My Goals

My long-term target is clear:

$3 million net worth

$125,000 per year in sustainable cash flow/withdrawals

If I hit $3M and allocate according to the target mix, here’s how the numbers might play out using conservative return assumptions:

What This Means

Even on the conservative side, this structure meets and slightly exceeds my $125K/year goal. Real estate remains the workhorse for steady cash flow, but equities and bonds provide stability, while cash and private equity add flexibility and upside.

Most importantly, this allocation spreads income across multiple sources—reducing risk and making the plan more resilient through different market cycles.

Final Thoughts

I’m not TIGER 21 material (yet!), but looking at how the ultra-wealthy invest has given me perspective. Their allocations reflect decades of entrepreneurial experience and a desire for both growth and resilience.

For me, the lesson is clear:

Keep real estate and equities as my core.

Add more liquidity and fixed income for flexibility.

Carefully introduce alternatives for diversification.

The big picture? Even if we’re not managing nine-figure fortunes, we can learn a lot by studying how the wealthiest structure their portfolios. The key is not to copy them blindly, but to adapt the principles to our own goals and stage of life.

👉 Question for readers: If you compared your portfolio to TIGER 21’s, where would you be overweight or underweight? And how would that change your path toward financial independence?

Disclaimer

This article is for educational purposes only and does not constitute financial or legal advice. Please consult a certified financial planner or tax professional before making investment decisions, especially concerning U.S. residency requirements for bank and brokerage accounts, as this is a grey area and may have legal implications. Always conduct thorough due diligence.