How I Teach Financial Literacy in Japan

And Why Every University Should Be Doing It

When I first started teaching financial literacy to my university students in Japan, I wasn’t sure what to expect. Would they care? Would the content feel too foreign or irrelevant? But year after year, I’m reminded that money is one of those topics that crosses borders, disciplines, and generations. Everyone—whether they admit it or not—is curious about how to manage it better.

What started as a small unit in my Communication Skills and English for Global Communication classes for economics students has evolved into something much more intentional: a four-lesson, grant-supported module funded by the Japan Society for the Promotion of Science (JSPS). I’m actively using this unit to collect data for my research on financial literacy education and behavioral change in young adults.

The method I’ve developed is both simple and layered: students start every task with nothing but pen, paper, and a worksheet, then progressively build up their understanding through technology and AI tools. This blend of analog calculation, digital learning, and AI tutoring helps ensure that the lessons stick—and that students aren’t just passively consuming information, but actively constructing their financial knowledge.

Why Teach Financial Literacy in an English Class?

Even though these students are economics majors, few have been taught how to manage their own money. That disconnect is a huge missed opportunity. By embedding financial education into an English course, we tackle multiple objectives at once:

Language learning with real-world application.

Critical thinking and data analysis.

Digital literacy, including responsible AI use.

Personal empowerment through money management.

And, frankly, the students love it—because for once, the subject matter feels immediately relevant to their lives.

The 4-Day Financial Literacy Journey: From Analog to AI

We start old school. Worksheets, calculations, handwritten notes. Students have to struggle with the numbers first. Then we introduce the tech—online videos, quizzes, retirement calculators, and AI language models like ChatGPT—to deepen their understanding and test their assumptions.

Here’s how it unfolds:

Day 1: Starting With Reality

We kick things off with a pre-survey using the Youth Financial Literacy Short Scale to capture where students stand in terms of financial knowledge, attitudes, and behaviors.

Then we dive into real-world financial storytelling through the CNBC Millennial Money episode featuring Gabriela Ariza:

👉 Living On $112K A Year In Brookfield, Illinois | Millennial Money

Gabriela’s journey from financial tragedy to becoming a money superstar always sparks rich discussion about resilience, budgeting, and long-term planning. Students are fascinated to see how someone close to their age navigated such adversity. (If you want to see what Gabriela is up to now, you can follow her on Instagram: @fab_millennial.)

We finish the session with reflective writing using our textbook, setting the stage for deeper financial exploration in the coming classes.

Gabriela Ariza

Day 2: Deepening Financial Knowledge with Digital Learning

Day 2 is our hybrid learning day. Using my co-authored textbook, Think Big for Business 1 (details here), students complete two structured activities:

Real Estate Investment Comparison: Students compare the pros and cons of investing in a countryside farmhouse versus an urban condo.

Creating a Diversified Investment Portfolio: They calculate how to distribute a monthly investment of $1,500 across US, Japanese, international, and real estate funds.

To supplement this, students watch the YouTube video “ACCOUNTANT EXPLAINS: How to Change Your Finances in 6 Months” by Nischa:

👉 Watch the Video

After watching, students complete a quiz on key concepts, such as:

Matching terms like index fund, emergency fund, bad debt, and net income.

Defining the ostrich effect.

Identifying the four key numbers to track.

Understanding decision fatigue and the role of automation.

Learning why “pay yourself first” is foundational.

This session layers vocabulary, conceptual understanding, and practical steps toward financial improvement.

Nischa:

Day 3: AI-Assisted Case Studies

Now it’s time to apply what they’ve learned. We begin by examining the Aya Financial Plan, a model example of a 28-year-old freelance graphic designer living in Kyoto who wants to retire by 60. We explore her income, expenses, budgeting, emergency fund, investment strategy, and her retirement target based on the 4% rule.

Then, in teams, students tackle one of four Japanese financial case studies, each with unique challenges—like balancing family expenses or reducing lifestyle inflation. They complete a handwritten financial worksheet, ensuring they understand every calculation.

Only after this do we introduce AI tools like ChatGPT. Students use AI to:

Validate their budget and retirement projections.

Seek investment recommendations.

Explore alternative financial strategies.

Compare systems in Japan and abroad.

Crucially, every group submits:

The handwritten worksheet with calculations.

A log of their AI usage, detailing prompts and reflections on AI’s strengths and weaknesses in financial planning.

Aya’s Financial Plan (Example Presentation I show Students)

Day 4: Presentations and AI Reflections

Each group presents their financial plan, explaining:

Budget revisions.

Investment strategy.

Projected retirement outcomes.

We also hold a structured reflection on AI:

What did you learn from using AI?

Did it help or hinder your understanding?

How might AI be useful in your studies or future career?

We close with a post-survey to measure growth in financial literacy and confidence. This feeds directly into my ongoing JSPS-funded research.

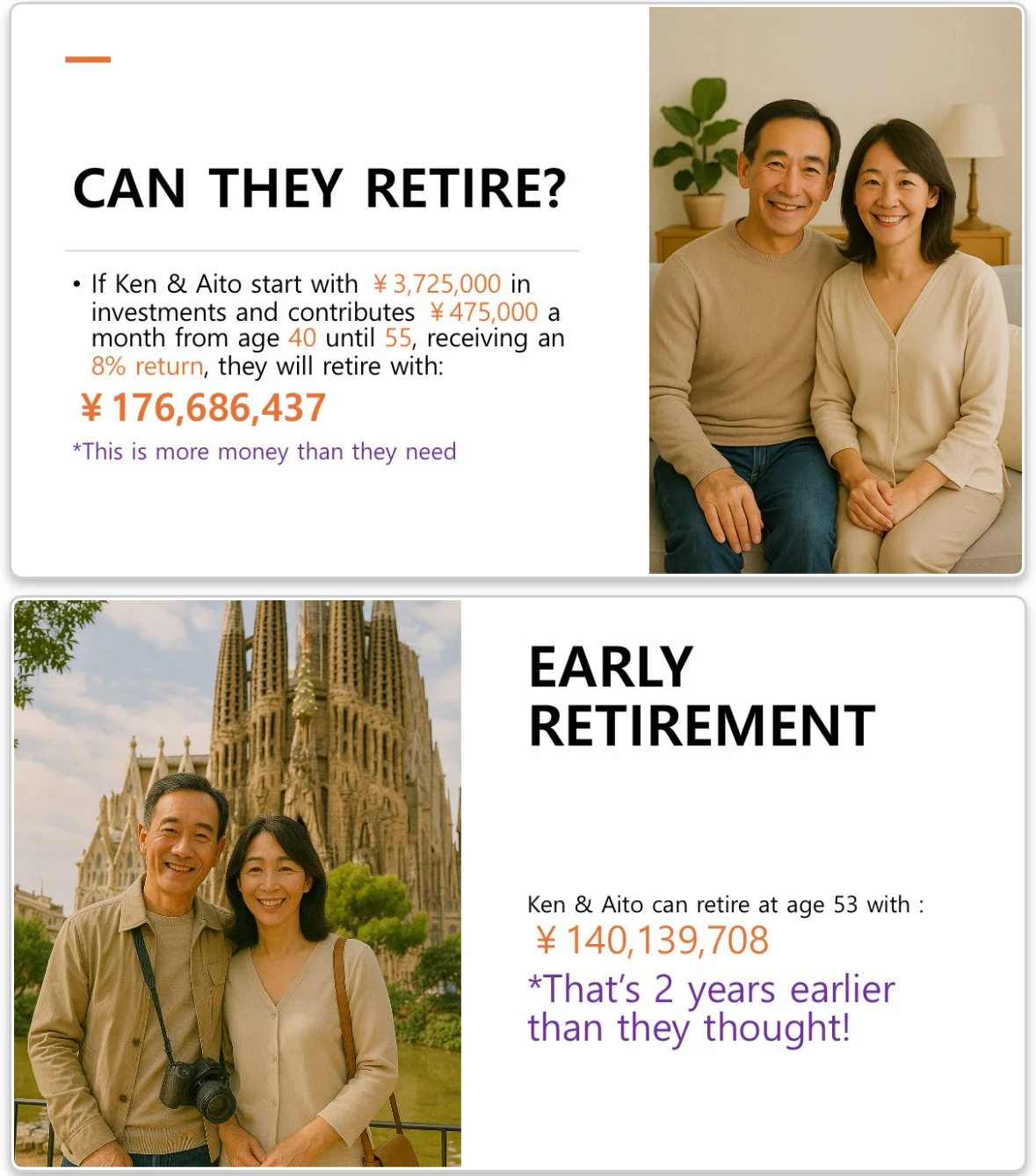

Example Slide from Student Presentation (1)

Example Slide from Student Presentation (2)

Why This Approach Works

There’s power in starting with analog tools, adding structured digital resources, and finishing with exploratory AI use. My students learn:

Financial concepts through doing, not just reading.

How to leverage technology responsibly.

That personal finance is solvable with the right tools.

They leave not just with knowledge—but with a practical roadmap they can adapt to their own lives.

Final Thoughts

I’m not trying to turn my students into financial advisors. But I do want them to feel that money isn’t mysterious—it’s manageable, predictable, and even empowering when you have the right skills.

If you’re an educator in Japan—or anywhere—and you want to explore the intersection of financial literacy, English education, and AI, I’d love to collaborate, swap ideas, or share resources.

— The FI Professor

📚 Resources From My Classroom

If you'd like to explore or adapt the materials I use in this unit, you can access everything here:

👉 Download the Full Financial Literacy Teaching Materials

This folder includes:

Aya Financial Plan (Model Example)

Financial Case Studies (4 Profiles of Japanese Adults)

Financial Worksheets (Hand Calculations + Planning Sheets)

Think Big for Business: Real Estate & Portfolio Activities

Student Quizzes and Prompts