Our 2025 Year-End Financial Reset

Every year, sometime between Christmas and New Year’s, my wife and I sit down together and do something that has become one of the most grounding rituals in our life.

We don’t start with investments.

We don’t start with net worth.

We don’t even start with money.

We start with getting organized.

Over the years, I’ve learned that financial clarity doesn’t come from knowing how much you have. It comes from knowing where everything lives, who can access it, and what would happen if one of you suddenly had to take over.

This post is the full version of our 2025 year-end financial reset — the one I don’t publish publicly. It includes the systems we use, the real numbers behind our finances, and a candid look at what worked, what didn’t, and what I’m carrying into 2026.

Before the Numbers: Getting the System Right

Before we look backward at the year, we make sure the foundation is solid.

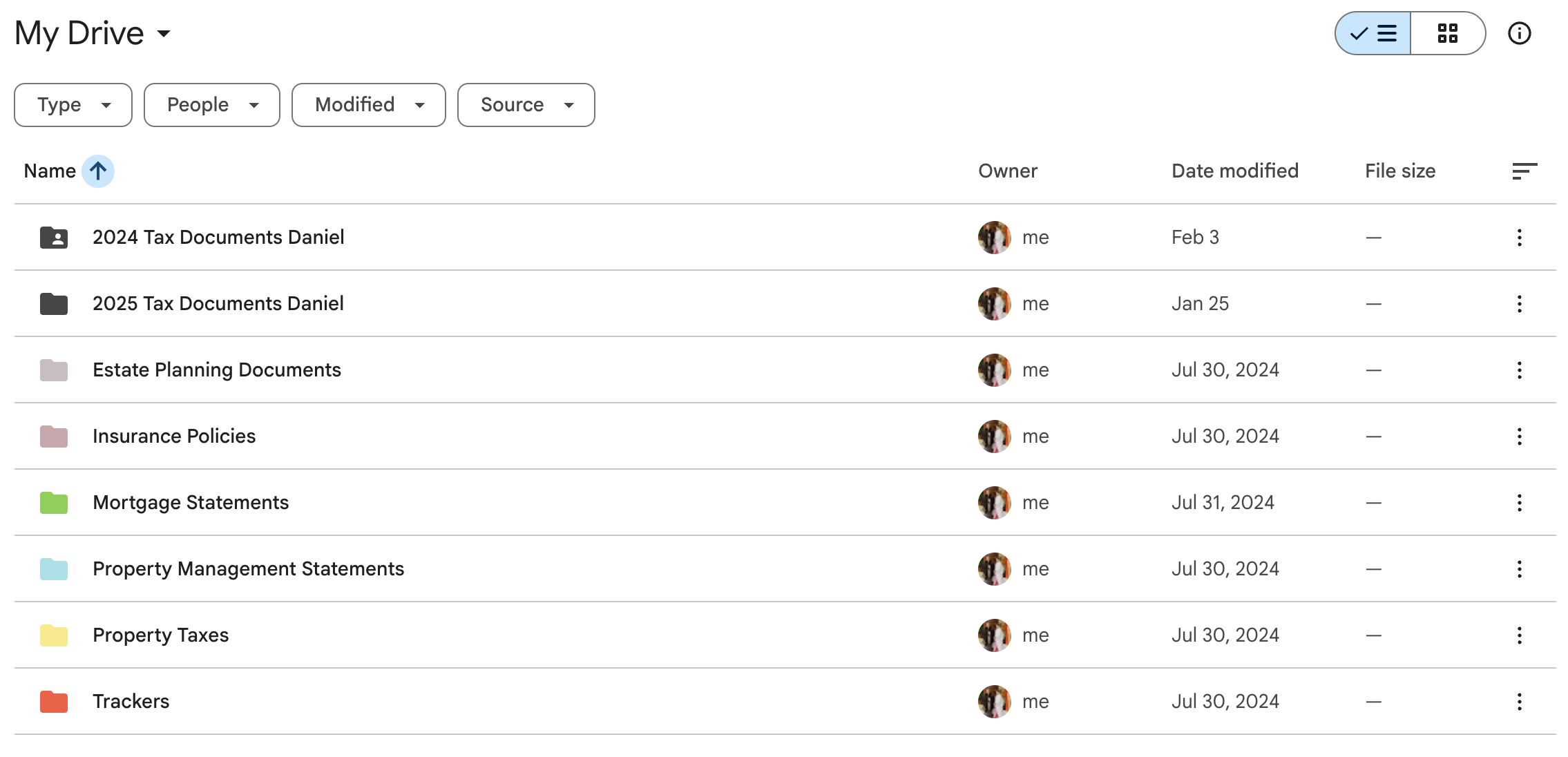

For us, that foundation is a shared Google Drive that functions as our financial home. All of our documents live there: tax documents organized by year, estate planning files, insurance policies, mortgage statements, property management reports, and the spreadsheets we use to track everything.

Nothing lives only in email.

Nothing lives only on one computer.

Nothing depends on one person remembering where it is.

At the end of the year, we go account by account and make sure everything is up to date. Brokerage statements. Bank statements. Property manager reports. Insurance renewals. Once that’s done, there’s a noticeable sense of calm — the feeling that we’re no longer carrying loose ends into the new year.

Financial Folder Organization System

Access Matters as Much as Organization

Organization alone isn’t enough. Access matters just as much.

We use a family password manager so that both of us can log into every bank, brokerage, property management portal, insurance site, and subscription we rely on. There is no version of our finances where only one of us “knows how things work.”

Because we live outside the U.S., we also rely on a VPN to access financial sites that block foreign IP addresses or behave differently overseas. It’s one of those tools you forget about until the day you really need it.

We also keep an old iPhone with a U.S. phone number specifically for verification codes. Anyone who’s ever been locked out of a bank account because an SMS can’t be delivered understands how valuable this is.

None of this is glamorous. All of it removes friction.

Updating the Trackers Together

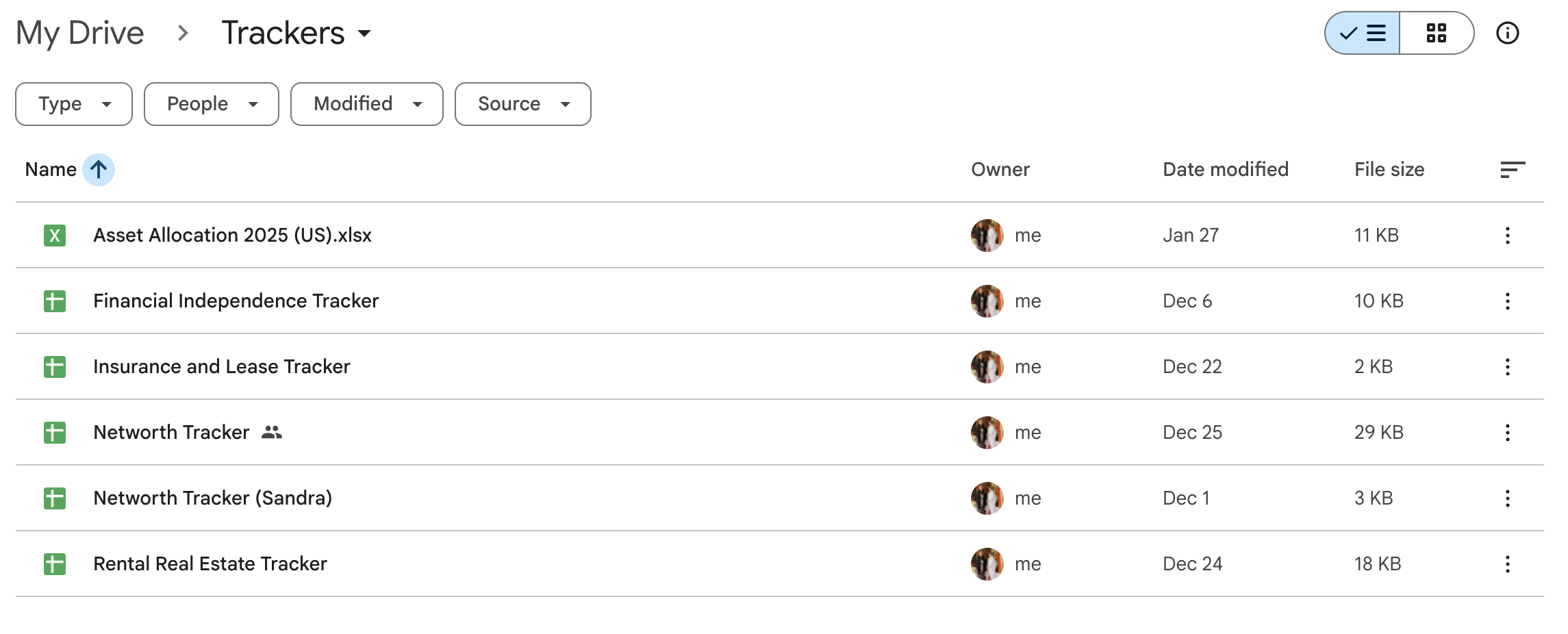

Only after documents are organized and access is confirmed do we open our trackers.

We update our net worth sheet, rental real estate tracker, asset allocation spreadsheet, and financial independence tracker together, line by line. No estimates. No “we’ll fix that later.”

Doing this together matters. The numbers stop being abstract and start feeling shared. There are no surprises and no mental load carried by just one person.

Financial Trackers

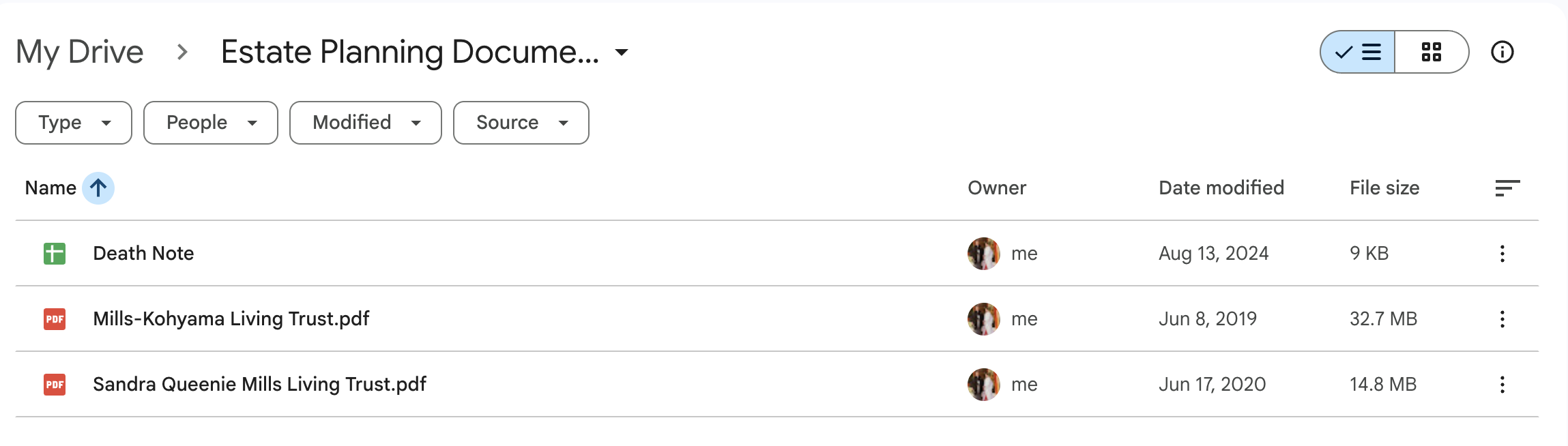

The Document We Hope We Never Need

The final part of our system review is what we half-jokingly call our “Death Note.”

It’s a living document that explains where everything is, who to contact, and what steps need to be taken if one of us is incapacitated or dies. It includes account lists, document locations, CPA and lawyer contact details, and basic procedures.

It’s uncomfortable to update. It’s also one of the most caring things you can do for your spouse. When it’s current, both of us sleep better.

Estate Planning Documents and Death Note

Proactive Tax Planning (Before the Year Ends)

Before we consider the year “closed,” we also use this time to schedule conversations with our CPAs in both the U.S. and Japan.

The goal isn’t just to prepare for tax season — it’s to make sure we’ve taken advantage of any beneficial programs before deadlines pass. This step alone has saved us more money over the years than any clever investment strategy.

Looking at the Numbers (With Context)

Once the system is solid, we step back and look at the year itself.

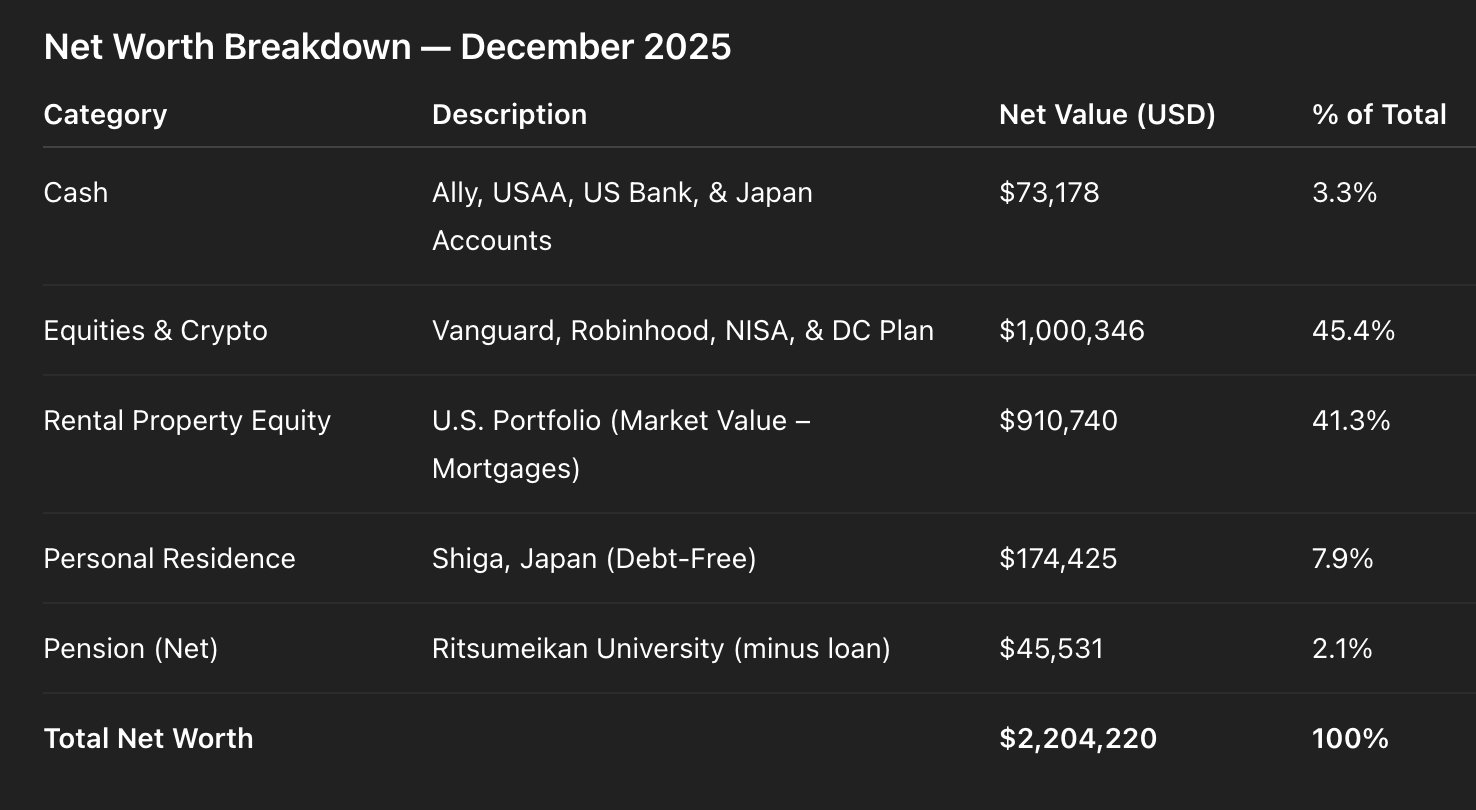

Rather than starting with a single net worth number, I find it more useful to look at how that net worth is structured — what’s liquid, what’s tied up in property, and how exposed we are to any single risk.

Below is a snapshot of our net worth as of December 2025, grouped by asset class. Rental properties are shown as net equity (market value minus outstanding mortgages), which I find far more honest than headline property values.

Net Worth Breakdown

What I like about this view is that it immediately answers the questions that matter most:

How much is liquid?

How much is growing in markets?

How much is tied up in real assets?

How leveraged are we, really?

A Closer Look at Rental Property Equity

The rental equity figure often raises questions, so it’s worth unpacking briefly.

That $910,740 in rental equity comes from 10 U.S. investment properties, and it reflects the net position, not the headline property values.

Here’s the underlying math:

Total market value of rental properties: $1,498,050

Total mortgage debt outstanding: ($587,310)

Net rental equity: $910,740

Looking at it this way keeps me grounded. Gross values feel impressive, but net equity is what actually matters for resilience and flexibility.

A Quiet Milestone in Investing

In December, my brokerage accounts crossed $1 million for the first time.

There was nothing dramatic about it. No big trade. No market timing. Just years of consistent investing, reducing idle cash, and letting compounding do its work.

It was less exciting than I expected — and more meaningful for that reason.

Rental Properties: The Full Picture

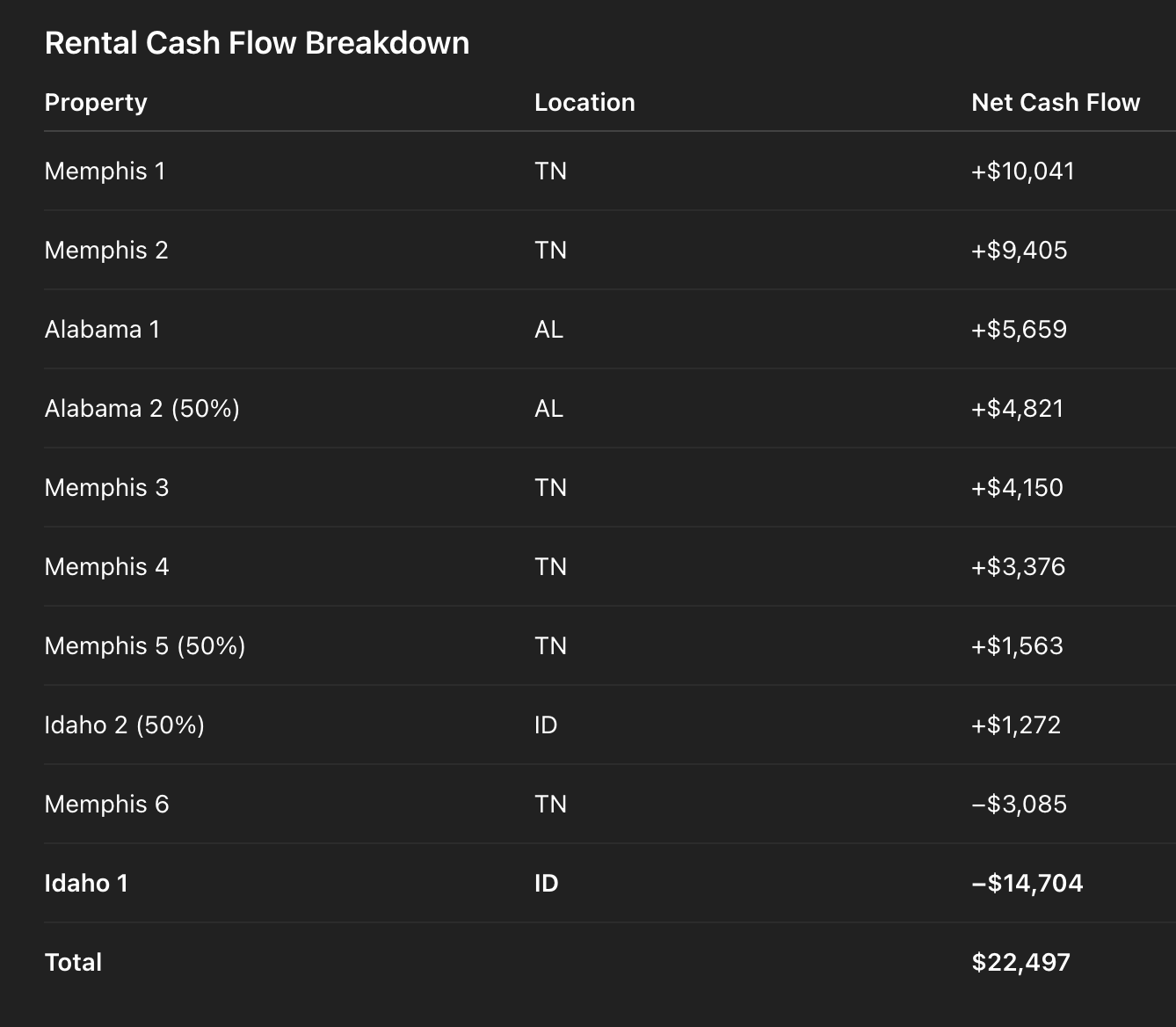

My rental real estate portfolio finished 2025 with $22,497 in net cash flow, but that number hides a lot of variation.

Most properties did exactly what you want rentals to do: collect rent, cover expenses, and quietly build equity.

One property, however, dominated the year.

The Property That Consumed the Year

One house in Idaho produced several months of zero rent while still requiring roughly $1,650 per month in mortgage and escrow payments. Legal fees, cleaning, repairs, and landscaping added over $5,700 on top of that.

That single property erased the combined profits of two of my strongest performers.

This is the side of real estate that rarely shows up online. Risk isn’t evenly distributed, and one problematic property can overshadow a dozen boring, well-behaved ones.

Rental Cash Flow Breakdown

Cash Flow Isn’t the Whole Return

Even in a year like this, tenants also paid down $21,383.98 in loan principal.

When you combine cash flow and equity growth, the total real estate return for the year was just under $44,000. That doesn’t make the eviction feel good — but it does keep the year in perspective.

What 2025 Reinforced for Me

This year reinforced a few things I already believed, but needed to experience again:

Boring assets are undervalued

Liquidity buys peace of mind

Systems matter more than optimization

Progress doesn’t need to feel good to be real

Looking Ahead to 2026

As we move into 2026, my focus is on reducing fragility, increasing flexibility, and keeping the system simple enough that it doesn’t demand constant attention — especially as we prepare for a sabbatical.

I’m also working on spreadsheets and guides that will help others — particularly U.S. expats — build systems like this for their own financial lives.

The goal isn’t perfection.

It’s clarity, resilience, and the freedom to focus on what matters most.

Disclaimer

This post reflects my personal financial journey and the systems my wife and I use. It’s shared to provide context and education, not as specific financial, investment, or tax advice. Your own situation will be different, and you should make decisions based on your goals, risk tolerance, and professional guidance.