How My Wife and I Do Our Year-End Financial Reset (and What 2025 Taught Us)

Every year, sometime between Christmas and New Year’s, my wife and I sit down at the dining table with our laptops and coffee and do something that’s become one of the most important rituals in our financial life.

We don’t start with investments.

We don’t start with net worth.

We don’t even start with money.

We start with getting organized.

Over time, I’ve learned that financial clarity doesn’t come from knowing how much you have. It comes from knowing where everything lives, who can access it, and what happens if something goes wrong.

Before I reflect on what 2025 looked like financially, I want to explain how we actually do our year-end reset — because without this system, the numbers don’t mean much.

One Shared Home for Everything

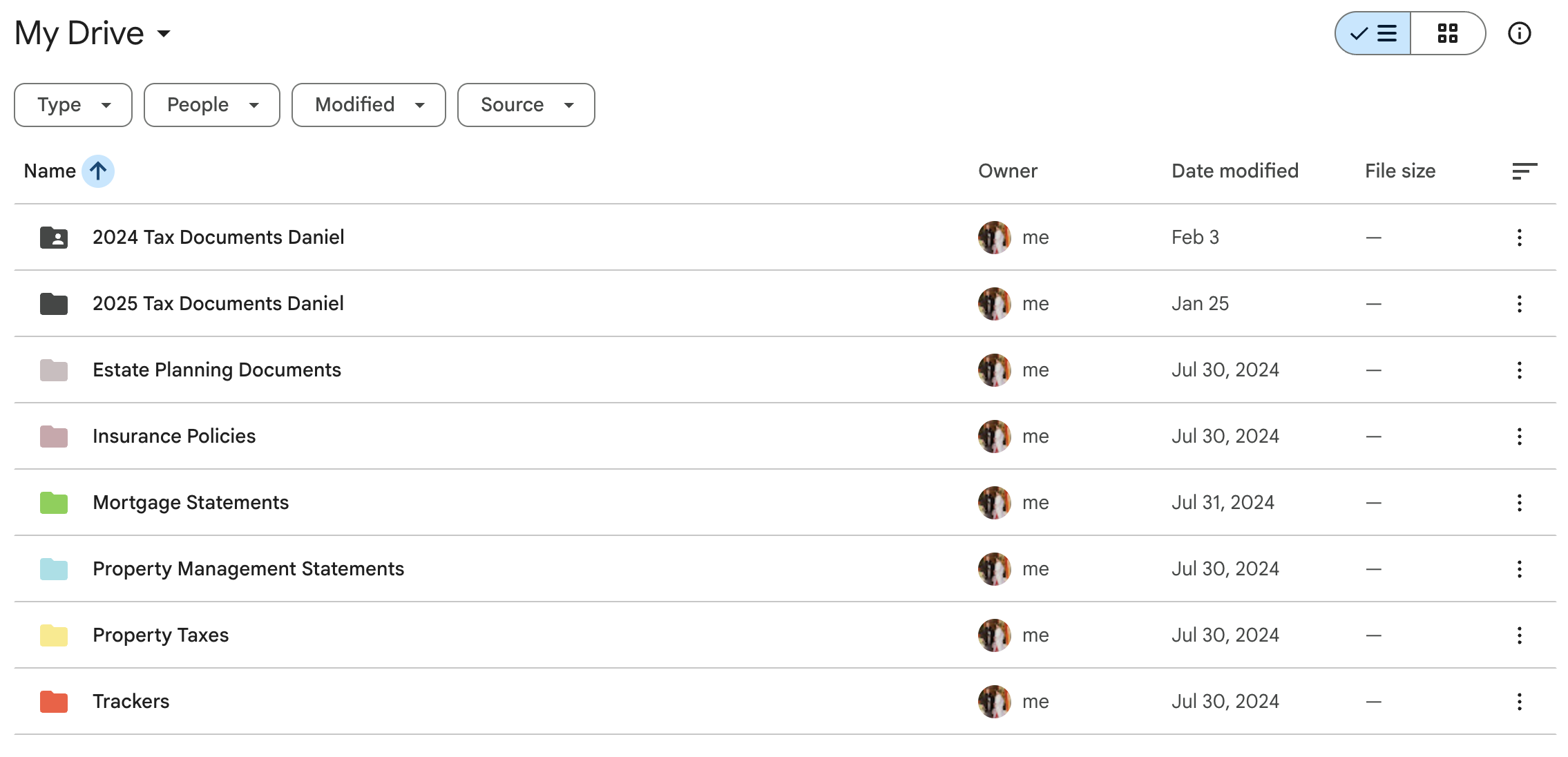

The foundation of our system is simple: one shared Google Drive.

All of our financial documents live there — tax documents by year, insurance policies, mortgage statements, property management reports, estate planning documents, and all of our trackers.

If you look at the screenshots below, you’ll notice how boring the structure is. That’s intentional. Clear folder names. Consistent organization. Nothing clever.

At the end of the year, we go through every account together and make sure the latest statements are downloaded and filed. Brokerage accounts, bank accounts, property manager statements, insurance policies — everything.

It’s not exciting work, but once it’s done, there’s a noticeable sense of calm.

Making Sure Either of Us Could Step In

Organization only works if access is shared.

We use a family password manager so that both of us can log into every bank, brokerage, property management portal, insurance site, and subscription we rely on. There’s no “only one of us knows how this works.”

Because we live outside the U.S., we also use a VPN to access financial sites that block foreign IP addresses or behave differently overseas.

And we keep an old iPhone with a U.S. phone number. Its entire job is to receive verification codes. If you’ve ever been locked out of an account because a bank insists on sending an SMS to a U.S. number, you understand why this matters.

None of this is fancy. All of it prevents stress.

Updating the Numbers Together

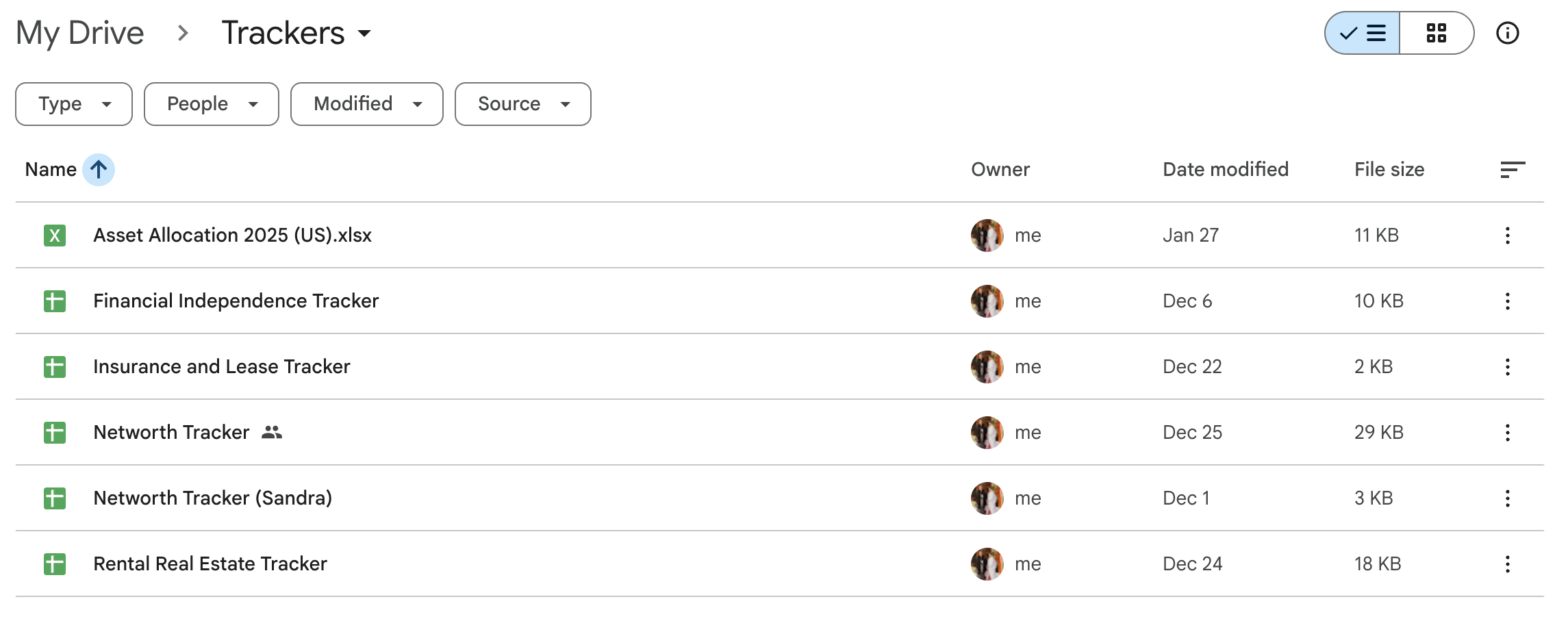

Only after everything is organized do we open our trackers.

We update our net worth, rental property tracker, asset allocation, and financial independence sheet together — line by line, no estimates, no shortcuts.

Doing this as a couple matters. The numbers stop being abstract. There are no surprises, no secrecy, and no mental burden carried by just one person.

The Document We Hope We Never Need

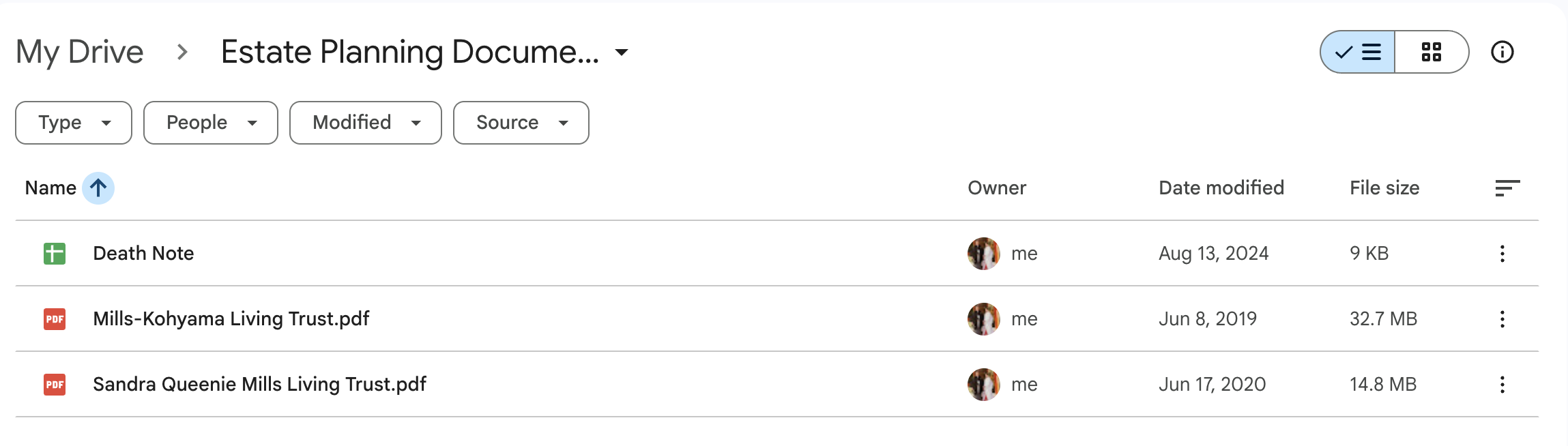

The final step is updating what we half-jokingly call our “Death Note.”

It’s a living document that explains where everything is, who to contact, and what steps to follow if one of us is incapacitated or dies.

It’s uncomfortable. It’s also one of the most practical and caring things you can do for your spouse.

What 2025 Looked Like at a High Level

Only after all of that is done do we step back and look at the year itself.

From a big-picture perspective, 2025 was a year of progress.

Our net worth increased by just under 7%, driven by steady market growth, continued investing, and ongoing debt paydown. We also crossed a meaningful psychological milestone in our investment accounts — one that took many years of boring consistency to reach.

At the same time, we deliberately reduced idle cash and moved toward a more balanced mix of liquidity and long-term investments. That shift mattered more than any single market move.

Rental Properties: Profitable, but Uneven

Our rental portfolio was profitable overall in 2025, but the experience was far from smooth.

Most properties did exactly what you want rentals to do:

Collected rent

Covered expenses

Quietly built equity

One property, however, dominated the year.

A prolonged vacancy and eviction turned a single house into a financial and mental drain. While the rest of the portfolio performed well, that one situation absorbed a disproportionate amount of cash flow and attention.

It was a reminder that in real estate, risk isn’t evenly distributed. One problem property can easily overshadow a dozen boring, well-behaved ones.

Why Cash Flow Isn’t the Whole Story

One thing that’s easy to forget — especially online — is that rental performance isn’t just about monthly cash flow.

Even in a year with setbacks, tenants continued to pay down loan principal and build long-term equity in the background. That doesn’t make a bad situation feel good in the moment, but it does matter when you zoom out.

Why I Share the Full Numbers Privately

Each year, I write two versions of this reflection.

This is the public one.

The private version includes:

My actual net worth figures

A full rental cash-flow breakdown

What that eviction really cost us

What I’m changing structurally going forward

I only share that version with my email list — not because the numbers are special, but because context matters, and I want to share them with readers who genuinely want the full picture.

If you’d like to read the complete version with real numbers, you can join below. I don’t email often — but once a year, I share everything.

👉 [Join the mailing list to receive the private year-end financial review]

Looking Ahead

I’m currently working on spreadsheets and guides for 2026 that will help others — especially U.S. expats — build systems like this for their own finances.

The goal isn’t perfection. It’s clarity, resilience, and peace of mind.

More soon.